For the past years Blockhchain has disrupted a lot of domains such as art, music, games, etc. Blockchain was initially used for the exchange or for dealing in cryptocurrency, Bitcoin. Since then, the technology has come a long. Another application of it has sprung up: cryptocurrency p2p lending, while p2p lending has been around for quite sometime it only logical that cryptocurrency p2p lending is deployed as all the applications of Blockchain are real world solutions. Bitcoins and other cryptocurrency are fulfilling this, across the BTC, BCH and ETH networks, credit is being supplied to ordinary citizens while bypassing its traditional gatekeepers, usurping the authority of banks and credit agencies in the process.

It is expected that by the year 2050, the global P2P lending industry will reach an annual turnover of 1 trillion USD.

What is P2P Lending?

Peer-to-peer (P2P) lending enables individuals to obtain loans directly from other individuals, cutting out the financial institution as the middleman. P2p lending has experienced rapid growth as borrowers look for alternatives to banks. As a result, the largest P2P lending platform in the US, Lending Club, went public in December 2014 with a successful IPO. Other platforms, such as OnDeck, have gone public as well, with many in line to do the same.

Crypto enthusiasts are raking in profits via Peer to peer (P2P) lending. To borrow an amount, the borrower needs to first deposit his/her cryptocurrency assets on the platform as collateral. The lender can lend the amount to a borrower and earn interest over it. Once, the borrower repays the loan with interest, he/she gets back his/her crypto assets from the crypto lending platform.

How is it different than traditional P2P Lending?

Peer-to-peer lending is an alternative financial system to banks that has been running, regulated or unregulated, for quite some time now. The essence of both traditional and nontraditional p2p lending to provide loan to the borrowers.

There are various online platforms available that act as an intermediary between lender and borrower, that operate exclusively in p2p lending business. The lending intermediaries are for-profit businesses; they generate revenue by collecting a one-time fee on funded loans from borrowers and by assessing a loan servicing fee to investors or borrowers (either a fixed amount annually or a percentage of the loan amount).

The lender’s investment in the loan is not normally protected by any government guarantee. On some services, lenders mitigate the risk of bad debt by choosing which borrowers to lend to, and mitigate total risk by diversifying their investments among different borrowers.

A cryptocurrency p2p lending is a decentralized system that runs on Blockchain. A decentralized credit system is a very attractive idea, especially when compared to conventional systems tied to large credit institutions. Companies like SALT Lending, Lendoit, and Jibrel Network have already launched a p2p lending platform using blockchain and smart contracts.

Blockchain technology allows borrowers and lenders to exchange funds without the need of an intermediary. Users “crowdsource” funds/ loans. A smart contract records the agreement on the blockchain. Borrowers are then able to receive the funds within 2 hours to max 7 days pending verification with very low transaction fees once they fulfill the conditions to execute the contract.

How is it done?

- Open an account with a cryptocurrency lending application and complete the verification process. You are required to provide the necessary KYC/AML identification, income verification, and some personal references.

- Once verified, login to your account and select your type of loan. The options vary with time limits, lending rates and the amount required.

- If the lender approves the loan request, the smart contract decides the fixed rate of interest for different types of borrowers by checking their creditworthiness.

- The amount will be received in the account in a few hours. The lending and borrowing service is available for anyone with an internet connection across the world.

- Start repaying your loans according to the timeline agreed with the lender.

Advantages of P2P Cryptocurrency Lending:

- Faster than conventional methods of getting a loan. The time reduction in verification and processing of the loan from 30 days+ to less than a week is exceptional.

- The peer to peer loans offer better rates than traditional loans.

- Some of the P2P lending platforms offer a market for loans where borrowers and lenders negotiate the interest rates and timespan for repayments. This offers better flexibility on the part of the borrower to repay the loan.

Disadvantages of P2P Cryptocurrency Lending:

- Blockchain and cryptocurrency being still in its infancy, the market for P2P lending through digital assets heavily depends on adoption

- The volatile nature of cryptocurrencies is a barrier to entry to the field of peer to peer lending

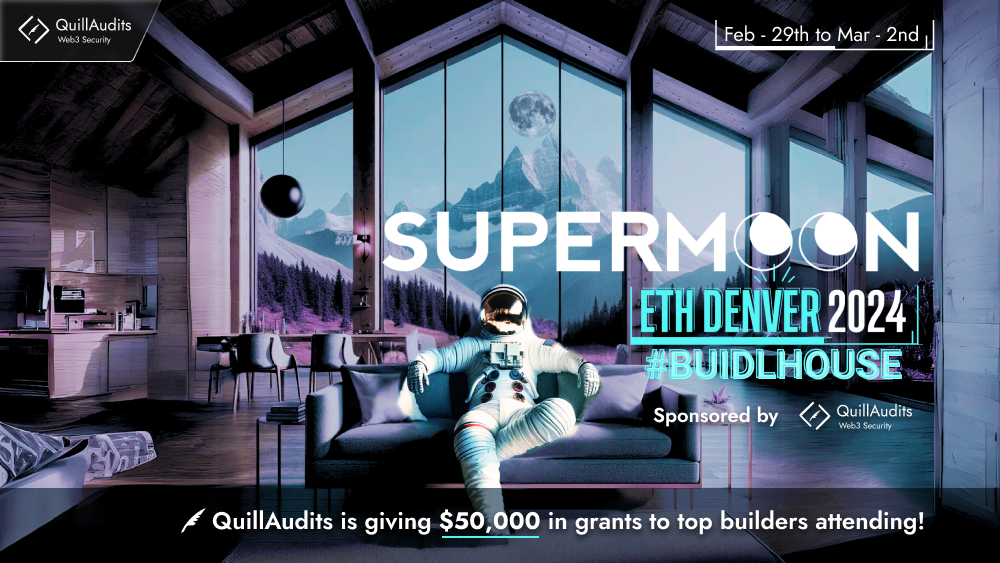

At QuillHash, We understand the Potential of Blockchain and have a good team of developers who can develop any blockchain applications like Smart Contracts, dApps, DeFi, DEX on any Blockchain Platform like Ethereum, EOS and Hyperledger.

To be up to date with our work, Join Our Community :-

Telegram | Twitter | Medium | LinkedIn