In the blockchain, real-world assets (RWAs) are digital tokens that stand for tangible and conventional financial assets, including money, raw materials, stocks, and bonds. As per DeFi Llama data, the current total locked value in Tokenized Real World Assets amounts to 3.9 billion dollars.

These encompass real estate, art, commodities, and intellectual property. Digitizing physical assets enhances liquidity, fractional ownership, transparency, and global accessibility, often seen as a means to modernize and democratize traditional financial markets.

However, tokenized real-world assets have downsides. Different places have different rules, so any token project needs to follow local laws. Security is also a big issue because digital assets can be targets for fraud and hacking. To keep these assets safe, we need good custody solutions and security measures.

Even with these challenges, tokenized real-world assets offer a promising innovation in the financial industry, providing more inclusive investment options. Tokenization is still new, and it might take time to be widely accepted in traditional finance. Technology, however, has the potential to transform how we handle and invest in physical assets.

Exploring the Mechanics of Tokenizing Tangible Assets

Tokenized real-world assets (RWAs) are digital tokens on the blockchain that stand for real things like money, goods, stocks, bonds, art, and ideas. This shift in how we deal with these assets opens up new chances for blockchain finance and many other uses, all thanks to cryptography and decentralized agreement.

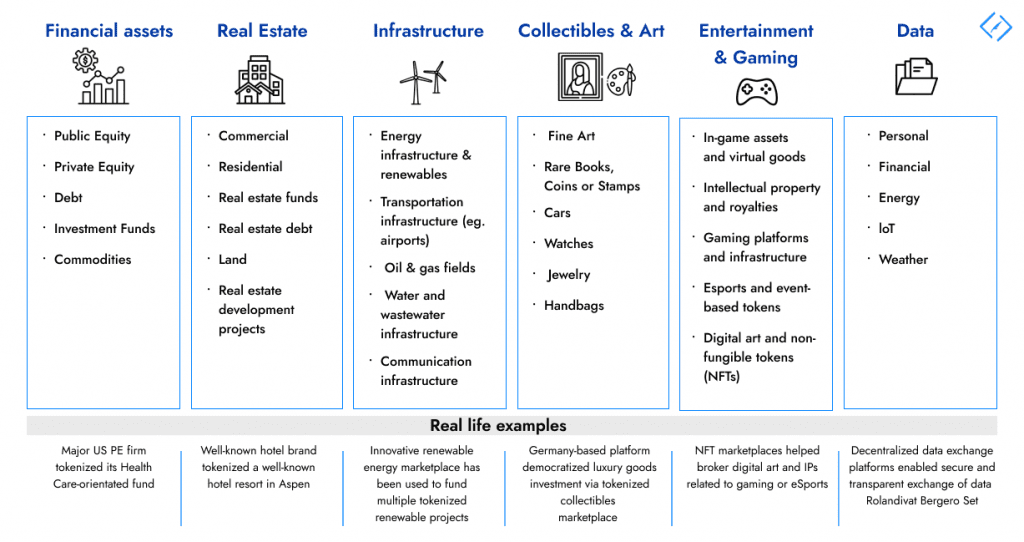

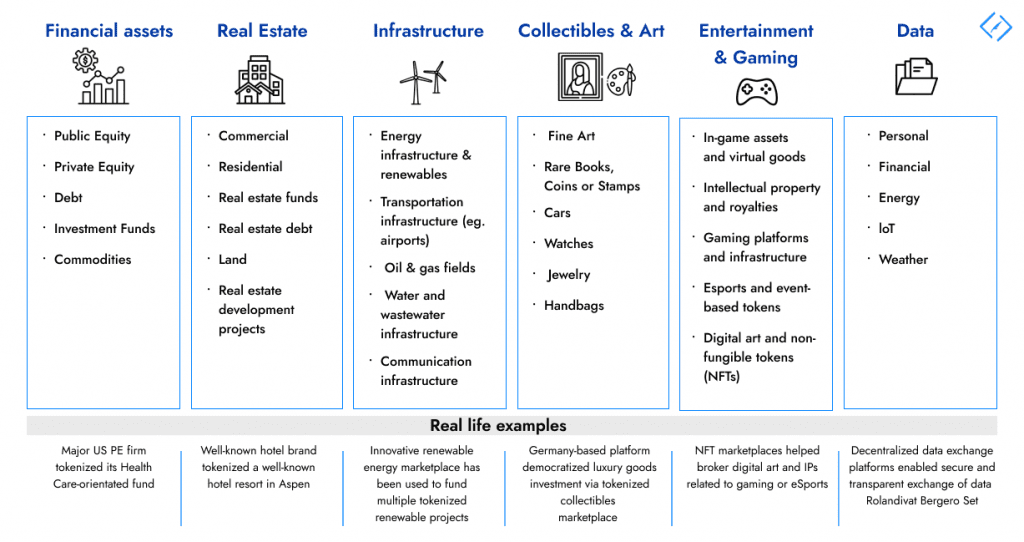

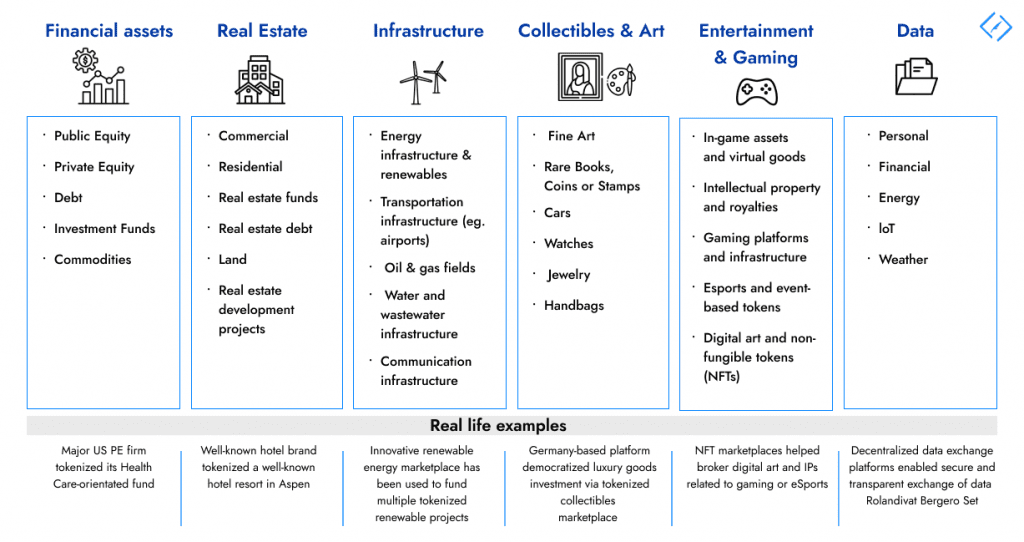

What Real-World Assets can be Tokenized? Real-world asset tokenization has opened up a plethora of opportunities across various sectors. Let’s explore some notable examples:

Tokenization in Art:- Art lovers can now own a piece of famous paintings through tokenization, where collectors buy “shares” of artworks like those by Andy Warhol, making art accessible at different price levels.

Tokenized Gold Market:- Tokenization is also changing the gold market, allowing investors to invest in precious metals without physical ownership. Tokenized gold has attracted over $1 billion in investments, appealing to both retail and institutional investors.

Tokenized U.S. Treasury Bonds:- In the bond market, tokenized U.S. Treasury bonds offer a digital representation of government-issued debt securities, making them easy to trade. The demand for these bonds is growing, with a market capitalization of nearly $500 million in tokenized money market funds.

Financial Instruments and Beyond:- Beyond art, gold, and bonds, financial firms explore tokenization for various assets like stocks and commodities. Tokenization’s potential extends beyond finance, with applications in real estate, manufacturing, and other industries.

Tokenized Real Estate:- Real estate tokenization turns real estate rights into digital tokens, allowing fractional ownership and creating new investment opportunities on blockchain-based platforms.

Blockchain + Smart Contracts: Tokenizing the Real World

Blockchain Role: Provides infrastructure for transparency, security, and decentralization crucial in asset tokenization.

Token Creation:

– Smart contracts create digital tokens representing ownership or fractional shares on the blockchain.

– Tokens can be fungible or non-fungible based on the underlying asset.

Security and Trust:

– Cryptography and digital signatures enhance security and trust.

– Only authorized parties can validate transactions, preventing manipulation of ownership records.

Ownership Transfer:

– Smart contracts enable secure and transparent asset ownership transfer upon meeting pre-conditions.

– Conditions may include payment completion or regulatory requirements.

Fractional Ownership:

– Smart contracts facilitate fractional ownership by dividing assets into smaller tokens.

– Allows multiple individuals to collectively own and trade fractions, making it accessible and affordable.

Liquidity and Secondary Markets:

– Blockchain platforms and decentralized applications (dApps) create secondary markets for buying, selling, and trading tokenized assets.

– Enhances liquidity by overcoming traditional limitations associated with physical asset transfer.

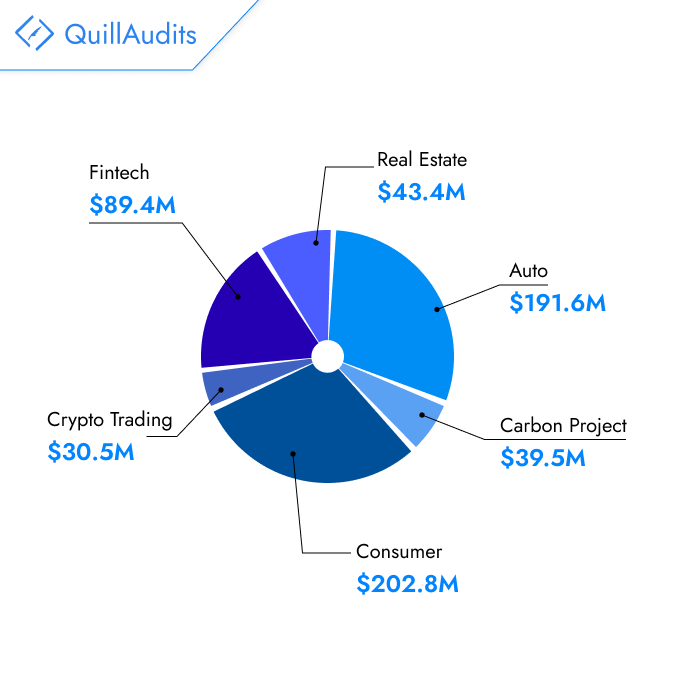

Examining the current landscape of real-world asset tokenization, the accompanying graphs illustrate the distribution of loans and the current total locked value in tokenized real-world assets. We can see two graphs for a comprehensive view: a pie chart showcasing the active loan value distribution across sectors like real estate, auto, fintech, crypto trading, consumer, carbon projects. Additionally, there’s another graph providing insights into the active loan value categorized by protocols such as centrifuge, goldfinch, truefi, etc.

Active Loans Value by Sector

Advancement in the Real Estate Industry Due to Asset Tokenization

Reshaping the global economy, real estate investment becomes more accessible through tokenization. Digital tokens on a decentralized ledger represent land and buildings, offering 24/7 operations, instant settlement, and programmability for increased automation and efficiency.

Blocksquare, a leader in this transformation, has tokenized $80 million of real estate across 19 countries, serving 85 properties. Their ‘PropToken’ smart contracts on Ethereum streamline the link between real estate and digital tokens, enhancing liquidity and accessibility. Beyond tokenization, Blocksquare’s white-label marketplace simplifies listing and selling tokenized real estate, while their entry into the DeFi market through Oceanpoint.fi merges real estate with decentralized financial markets.

Navigating the Complexities and Risks of Asset Digitization

Tokenizing real-world assets (RWA) holds significant potential, but numerous obstacles may impede its widespread adoption and growth. Let’s delve into some key challenges:

1. Regional Regulatory Variances: Inconsistent and unclear regulations across regions hinder RWA adoption, limiting industry potential.

2. Asset Valuation: Accurately valuing illiquid or unique assets is challenging, impacting investor confidence. Trusted service providers and robust valuation methods are essential.

3. Scalability and Interoperability: Efficiently handling high transaction volumes and seamless communication between different blockchain platforms are crucial for RWA growth. Solutions for scalability and interoperability are still in development.

4. Investor Education and Awareness: Bridging the knowledge gap among investors is crucial for RWA adoption. Awareness of potential benefits and risks is necessary, as lack of investor confidence poses a significant challenge.

5. Technology and Platform Risks: Various risks, including coding errors, network security, platform and asset management risks, and wallet breaches, present barriers to RWA adoption. Addressing these issues is vital for global RWA adoption improvement.

Solutions for Overcoming Tokenization Hurdles

1. Asset Auditing & Verification: It’s crucial to verify the authenticity and value of the underlying asset. Companies like QuillAudits provide thorough auditing services to ensure the asset’s integrity when represented as a token.

2. Custodial Services: Safely storing the underlying assets is paramount. Services such as Coinbase Custody offer secure storage solutions, especially for institutional-grade needs.

3. Legal & Compliance Tools: Adhering to local and international laws during tokenization is vital. Platforms like OpenLaw provide tools and frameworks to ensure legal compliance throughout the process.

4. Token Management Platforms: Platforms like Harbor simplify business processes by offering tools for issuing, managing, and trading Asset-Backed Tokens (ABTs).

5. Oracles: Real-world asset values can fluctuate. Oracles like Chainlink provide real-time data to smart contracts, ensuring the token’s value aligns with the asset’s current value.

6. Decentralized Finance (DeFi) Platforms: Aave allows businesses to utilize their ABTs for financial operations, such as lending, borrowing, or earning interest.

7. Maintain Transparency: In the digital world, trust is essential. Always provide clear, accessible information about the underlying asset and its valuation.

8. Prioritize Security: Protect your token against potential threats with robust security measures on both the blockchain platform and smart contracts.

9. Engage with the Community: A thriving community is a token’s greatest asset. Foster engagement, gather feedback, and build trust among users.

10. Stay Updated with Regulations:The regulatory landscape is ever-changing. Stay informed about changes to ensure continuous compliance throughout the tokenization process.

11. Collaborate with Experts:The world of Asset-Backed Tokens (ABTs) is vast. Collaborate with experts in blockchain, legal, and marketing for a comprehensive approach.

12. Liquidity is Key: A token’s value lies in its utility. Ensure your token’s accessibility and tradability by listing it on reputable exchanges.

The Future of RWA Tokenization

According to their insights, Roland Berger predicts that asset tokenization will reach a market value of at least USD 10 trillion by 2030. This marks a 40-fold increase in the value of tokenized assets from 2022 to 2030, a significant jump from the current value of around USD 300 billion. Their market size estimate is based on proprietary analysis, incorporating current data on public and private equity, debt, real estate, and other relevant asset categories for tokenization. Applying conservative growth rates (2% to 8%) for asset values and multiplying them by a likely tokenization share (up to 1%), they project that real estate and financial assets, including equities, bonds, and investment funds, will dominate the tokenized market due to their substantial underlying market sizes and prevalent use cases.

Conclusion

Tokenization of real-world assets (RWAs) brings significant benefits, including increased liquidity, fractional ownership, and enhanced transparency, which collectively democratize access to various asset classes. Despite the challenges such as regulatory complexities and security concerns, the potential for innovation in financial markets is undeniable.

Looking ahead, the future of RWA tokenization appears bright, with predictions suggesting a significant market expansion. It is crucial for stakeholders to stay informed and actively engage in this evolving landscape, contributing to the development of a more accessible and efficient asset ownership framework.

FAQs

- What are Oracles?

A blockchain oracle is a third-party service that connects smart contracts with the outside world. Oracles are a type of smart contract that take data from the outside world and put it into the blockchain for other smart contracts to use.

- What is Aave?

Aave is a decentralized cryptocurrency platform that allows users to borrow and lend cryptocurrencies. It’s a non-custodial money market platform that offers a variety of debt-based products.

- What is PropToken?

PropToken is an Ethereum ERC-20 smart contract with a maximum issuance of 100,000 digital tokens. It includes unique details identifying a specific real estate property and follows transactional rules based on the issuer’s requirements.