Decentralized finance (DeFi) relies on Ethereum staking to secure the blockchain and maintain consensus. Restaking allows liquid staking tokens to be staked with validators in other networks. It enables users to earn rewards and enhance network security via Proof of Stake (PoS). Essential to Ethereum 2.0, it secures the network, promises enhanced capital efficiency, and improves ecosystem reliability.

EigenLayer, a leader in Ethereum restaking, has seen its total value locked (TVL) jump significantly this year. The TVL has skyrocketed from $1.1 billion to $10.724 billion, equivalent to roughly 3.2 million ether. This incredible growth has made EigenLayer the second-biggest player in DeFi, right behind Lido. EigenLayer lets you put your existing Ethereum holdings from different staking services back into a “restaking” pool. This allows those funds to be used to secure other blockchain networks, potentially earning you additional rewards.

What is Eigen Layer?

EigenLayer, a framework established on Ethereum, introduces restaking, a new element in cryptoeconomic security. This component facilitates the reuse of ETH within the consensus layer. Individuals who commit their ETH natively or through a liquid staking token (LST) can participate in EigenLayer smart contracts. These contracts enable them to restake their ETH or LST, expanding cryptographic security to more network applications and gaining extra rewards.

Here’s what EigenLayer offers:

Staking ETH:

- EigenLayer allows customers to reuse staked ETH for additional rewards.

- Customers can secure other Ethereum-based apps with their staked ETH.

Shared Security:

- EigenLayer creates a shared security pool through restaking.

- Extends Ethereum’s security to new apps, saving time and costs of creating validator sets.

Unlocking Innovation:

- EigenLayer’s restaking enables developers to create previously unfeasible Ethereum apps.

- Enhances Ethereum’s ecosystem with dynamic and inventive applications.

Unprecedented Demand

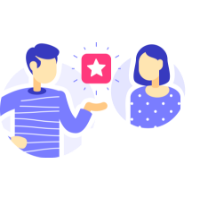

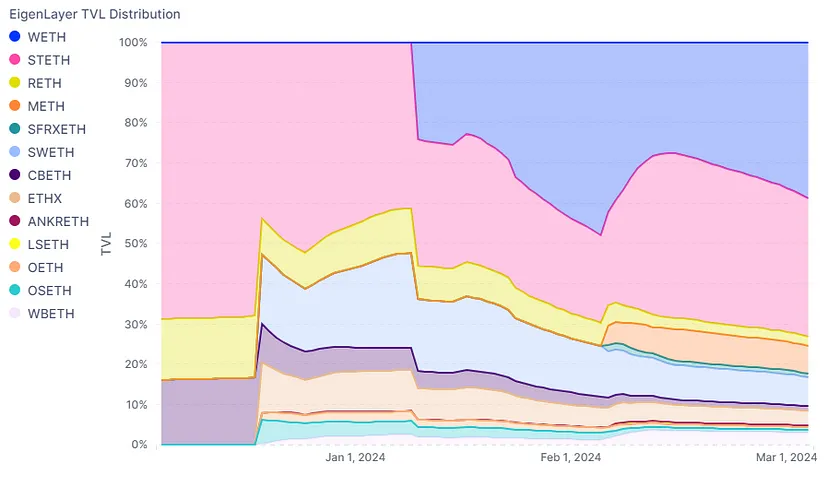

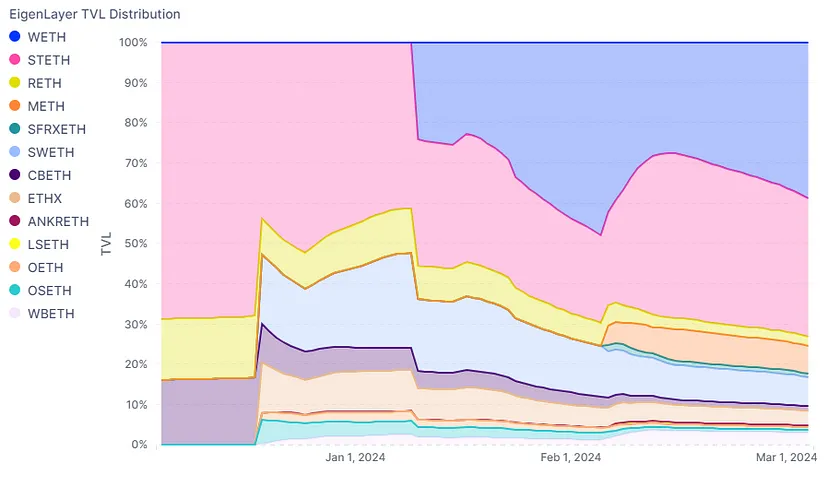

The TVL composition reveals a dominance of WETH and stETH, supported by Eigenlayer. WETH is favoured for staking via EigenPods, indicating strong demand for restaking. This preference likely reflects a reluctance to hold liquid staking tokens directly, favouring safer exposure mechanisms for staking rewards.

EigenLayer TVL Distribution chart from IntoTheBlock EigenLayer Dashboard

Understanding How EigenLayer Works

EigenLayer enhances the capabilities and safety of Ethereum’s staking mechanism through a technique known as restaking. Here’s a simplified explanation of its operation:

- To start staking, deposit ETH or liquid staking tokens (stETH, rETH, cbETH) on the Ethereum network through the EigenLayer app.

- Once users stake their assets, they can engage with EigenLayer by selecting smart contracts crafted by the protocol.

- Restaking in Ethereum’s ecosystem secures dApps via Active Validator Services, diversifying investments and boosting rewards.

- EigenLayer’s structure enables stakers to join multiple security pools, reducing capital requirements and bolstering trust and network security.

- EigenLayer offers stakers the option to delegate their restaked assets to operators, who specialize in managing the restaking process with tailored strategies.

- The protocol utilizes smart contracts like EigenPod and StrategyManager for native restaking and delayed withdrawals, ensuring operational efficiency.

- For security, EigenLayer enforces a hold period, usually about seven days, enhancing safety in the restaking process.

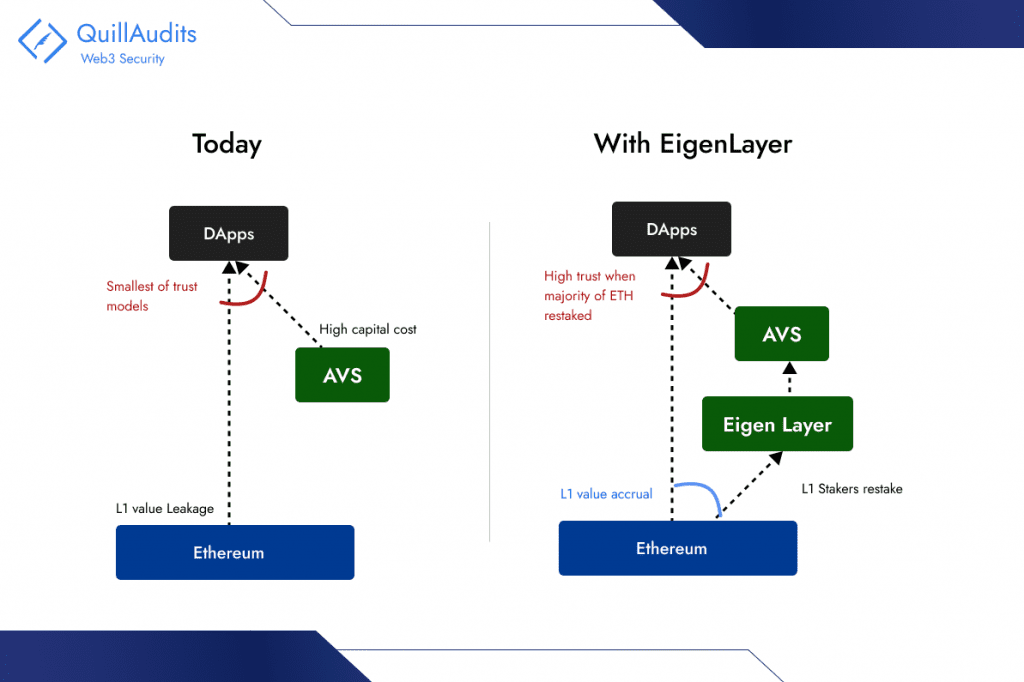

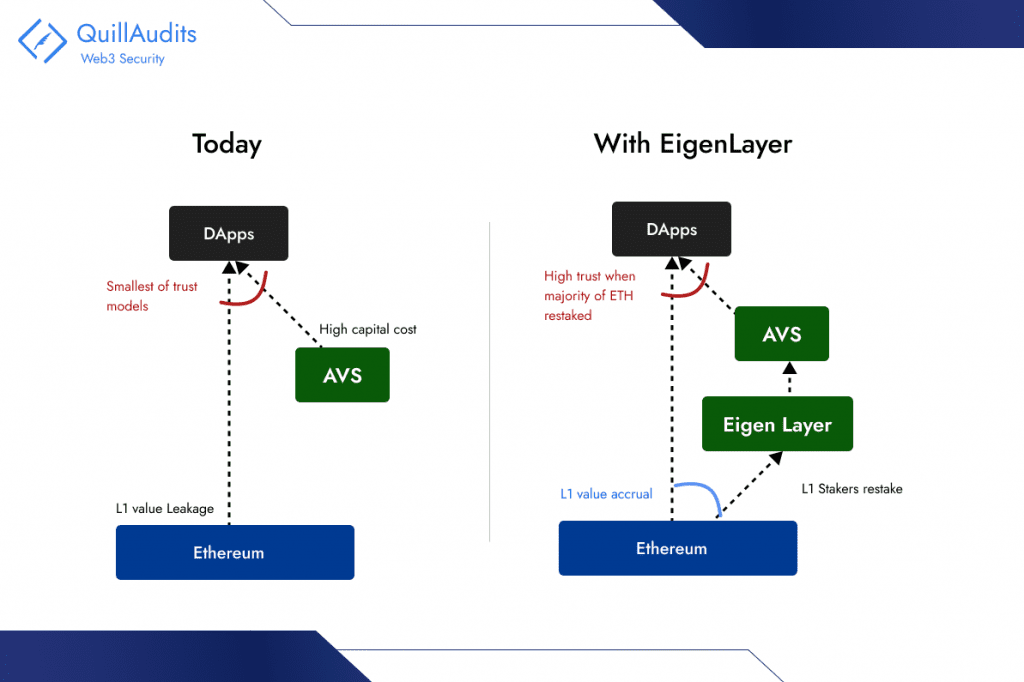

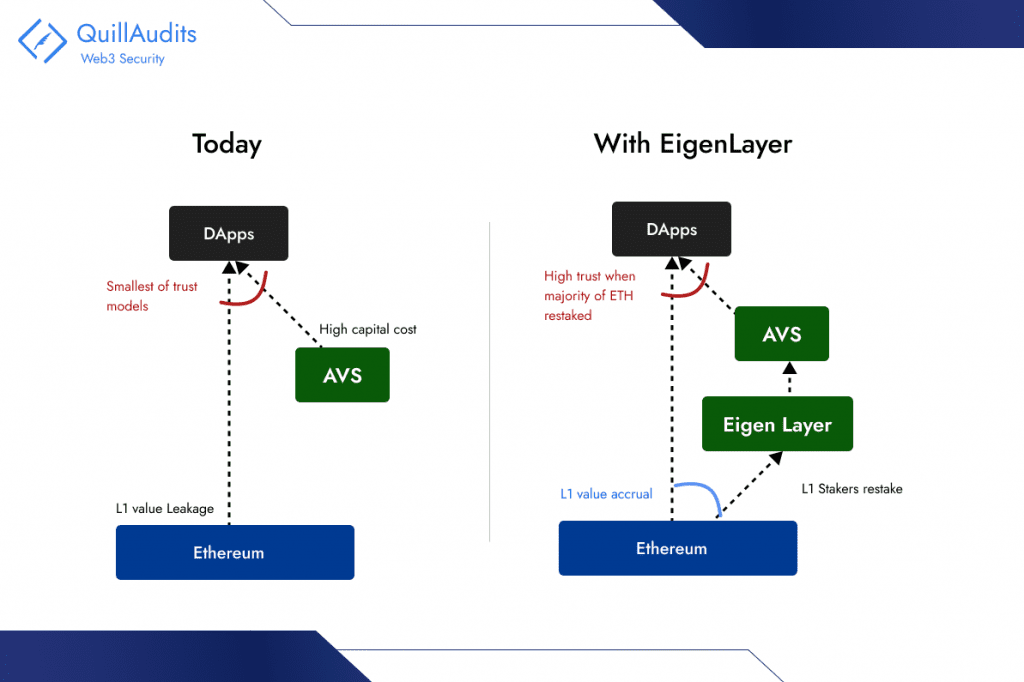

Comparing the ecosystem of actively validated services today and with EigenLayer

Ethereum Security Issues and Benefits of EigenLayer Restaking

Ethereum Security Issues

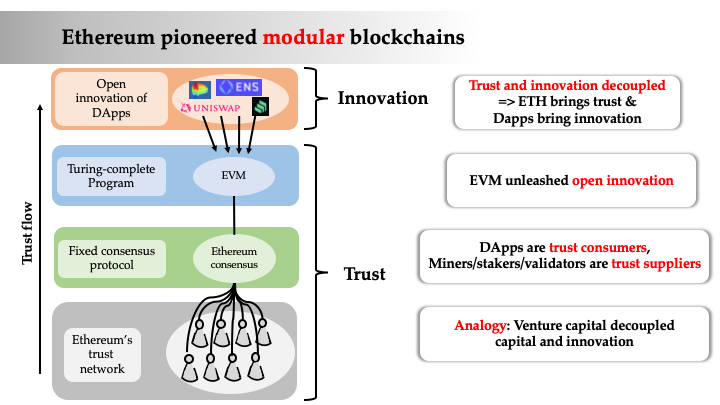

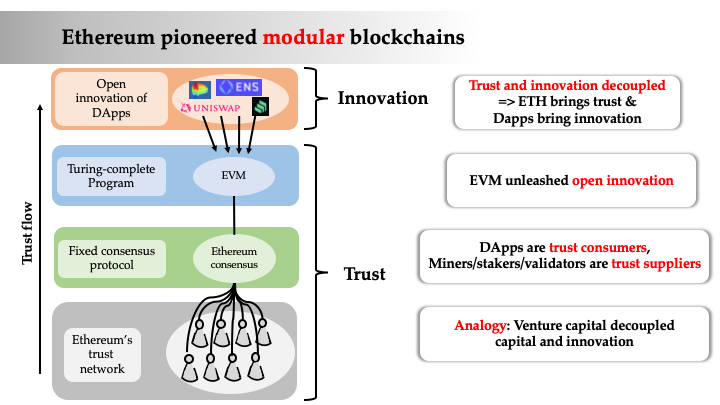

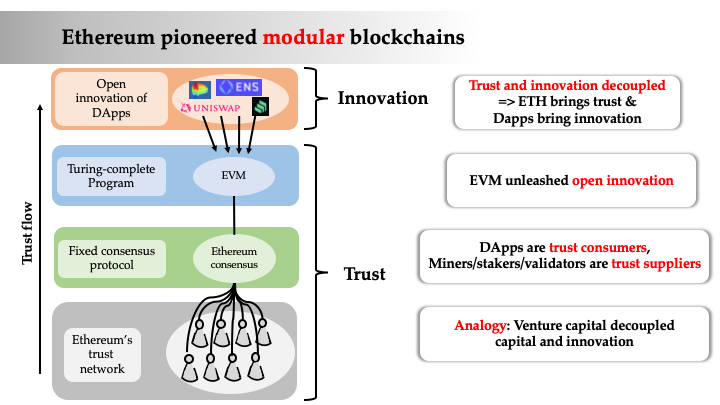

1. Trust vs. Innovation Divide: Ethereum’s architecture separates the base layer’s trust provision from the innovation at protocol and application levels, potentially undervaluing the base layer’s role in security.

2. Throughput and Trust Bottlenecks: Ethereum’s consensus mechanism’s limited capacity creates bottlenecks, affecting performance and trust, particularly for applications farther from the base layer.

1.2) This fragmentation leads to several issues. First, "Trust bottlenecks".

— Felix (@Folifoxx) June 6, 2022

Note that the trust of a system is only as strong as its weakest layer (=bottleneck).

E.g. In a modular stack = trust is bound by the weakest layer.

3. Cost of Capital: Protocols may need to issue tokens to incentivize security, which can dilute value and create economic pressures.

4. Trust Fragmentation: DApps and bridges that do not use EVM face challenges leveraging Ethereum’s base-layer security, leading to fragmented trust.

5. Middleware Security Burden: Developers of oracles and bridges bear the heavy burden of ensuring security without direct support from Ethereum’s base layer.

6. Ethereum needs more open innovation due to limitations in consensus protocol upgrades and middleware development without new trust networks.

19) But there is a limitation in Ethereum on open-innovation. If you have a new consensus protocol upgrade, it cannot be built permissionlessly on Ethereum. If you have a new middleware like Data Availability layer, you need new trust networks.

— Sreeram Kannan (@sreeramkannan) May 28, 2022

Benefits of Eigen Layer:

1. EigenLayer tackles Ethereum’s governance issue: balancing innovation speed with decentralized governance, resolving a major dilemma for all protocols.

21) EigenLayr also solves the massive governance problem at the center of Ethereum: *all* protocols today have to make a tradeoff between agility of innovation vs decentralized governance.

— Sreeram Kannan (@sreeramkannan) May 28, 2022

2. EigenLayer enables ETH restakers to assume extra slashing risks, fostering open innovation and leveraging the ETH trust network.

20) EigenLayr solves this open innovation problem. By allowing ETH restakers to take on additional slashing risks, EigenLayr allows ETH stakers to *opt in* to provide additional services. Anyone building a new distributed system can simply leverage the ETH trust network.

— Sreeram Kannan (@sreeramkannan) May 28, 2022

3. EigenLayer offers data services like EigenDA for Ethereum, promising cheaper and faster data availability than its base layer. Ethereum handles 80 kilobytes per second, whereas EigenLayer will enable processing speeds of up to 15 megabytes per second.

4. EigenLayer offers a foundation for developing middleware services and decentralized applications (DApps).

5. EigenLayer accelerates validator network creation with lower costs and higher throughput, specializing in decentralized rollup attestations for EigenDA.

What is EigenDA ?

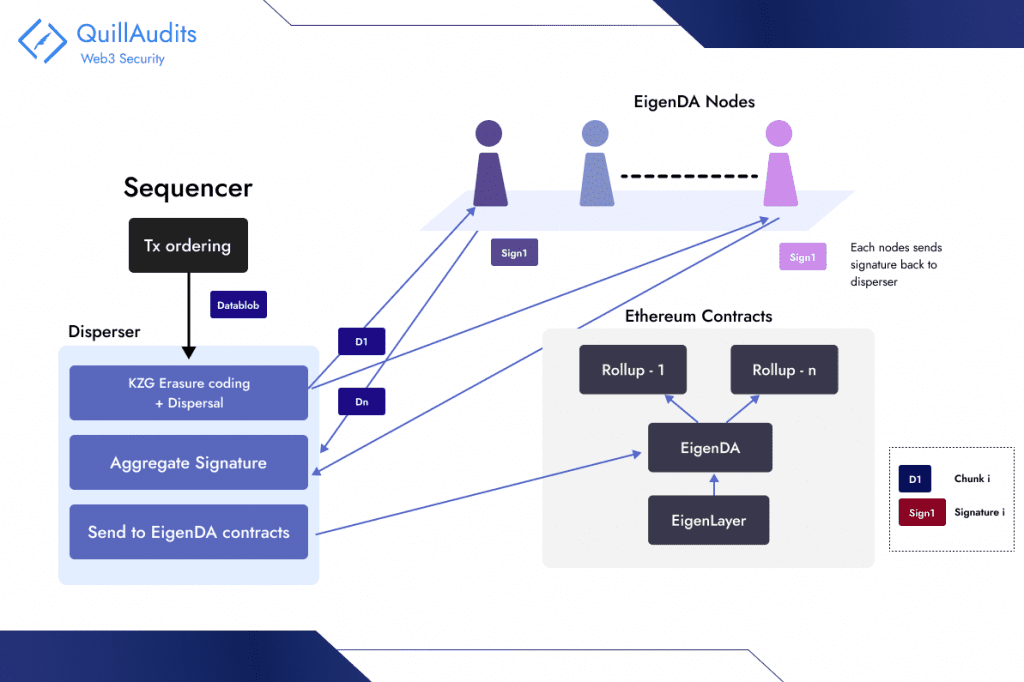

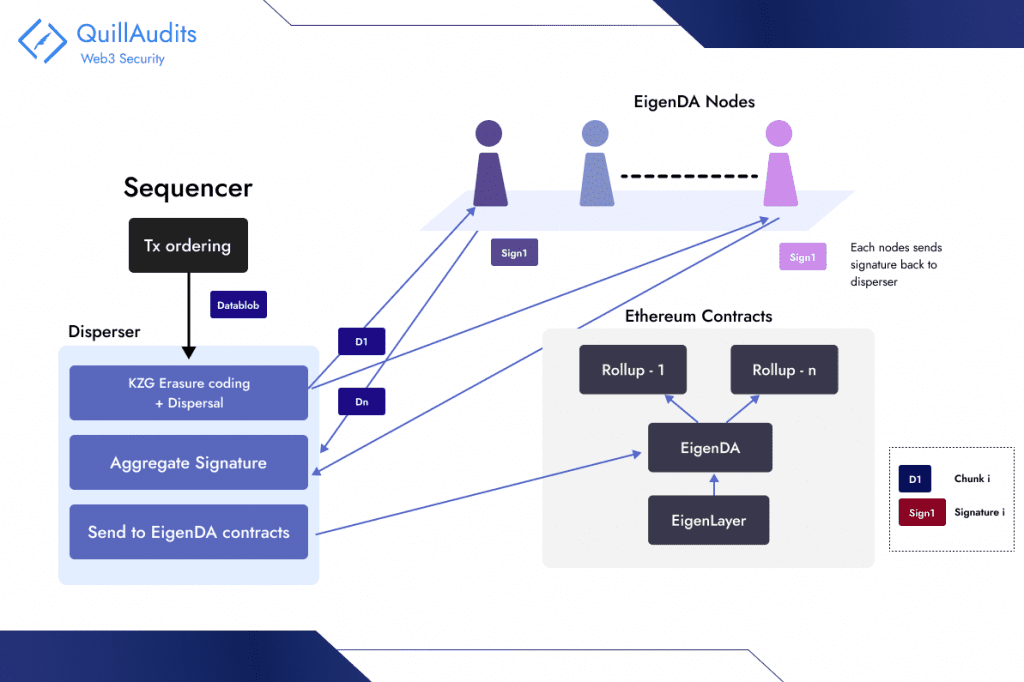

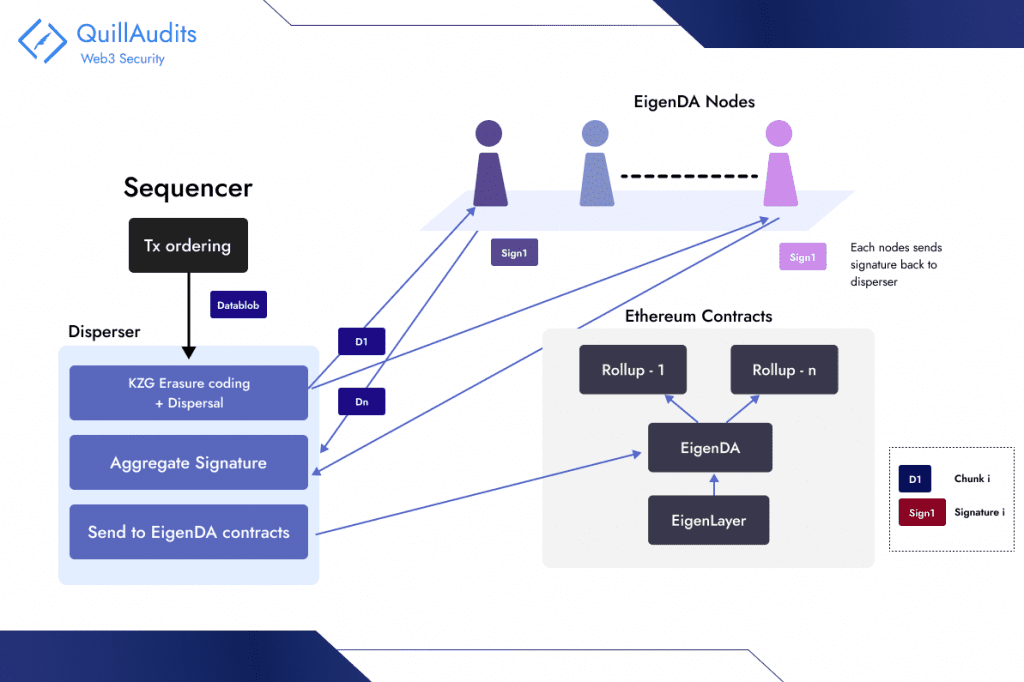

EigenDA Architecture

EigenDA, developed by EigenLabs, is a decentralized data availability service, integrated with Ethereum via the EigenLayer protocol. EigenLayer’s first actively validated service (AVS) brings secure, high-throughput data storage to blockchains. The system achieves scalability in line with network growth. It allows restakers to allocate their stakes to node operators for validation purposes, in return for service rewards, thereby enhancing transaction efficiency and reducing costs.

In the world of Ethereum, especially concerning ZK and Optimistic rollups, data availability is paramount for the seamless operation of these technologies. EigenDA plays a crucial role by maintaining a reliable and secure architecture that ensures transaction data is always accessible. This accessibility is important for operations like asset transfers in rollups. It’s crucial for Optimistic rollups, supporting state commitments verification and fraud proof creation, enhancing blockchain system functionality and reliability.

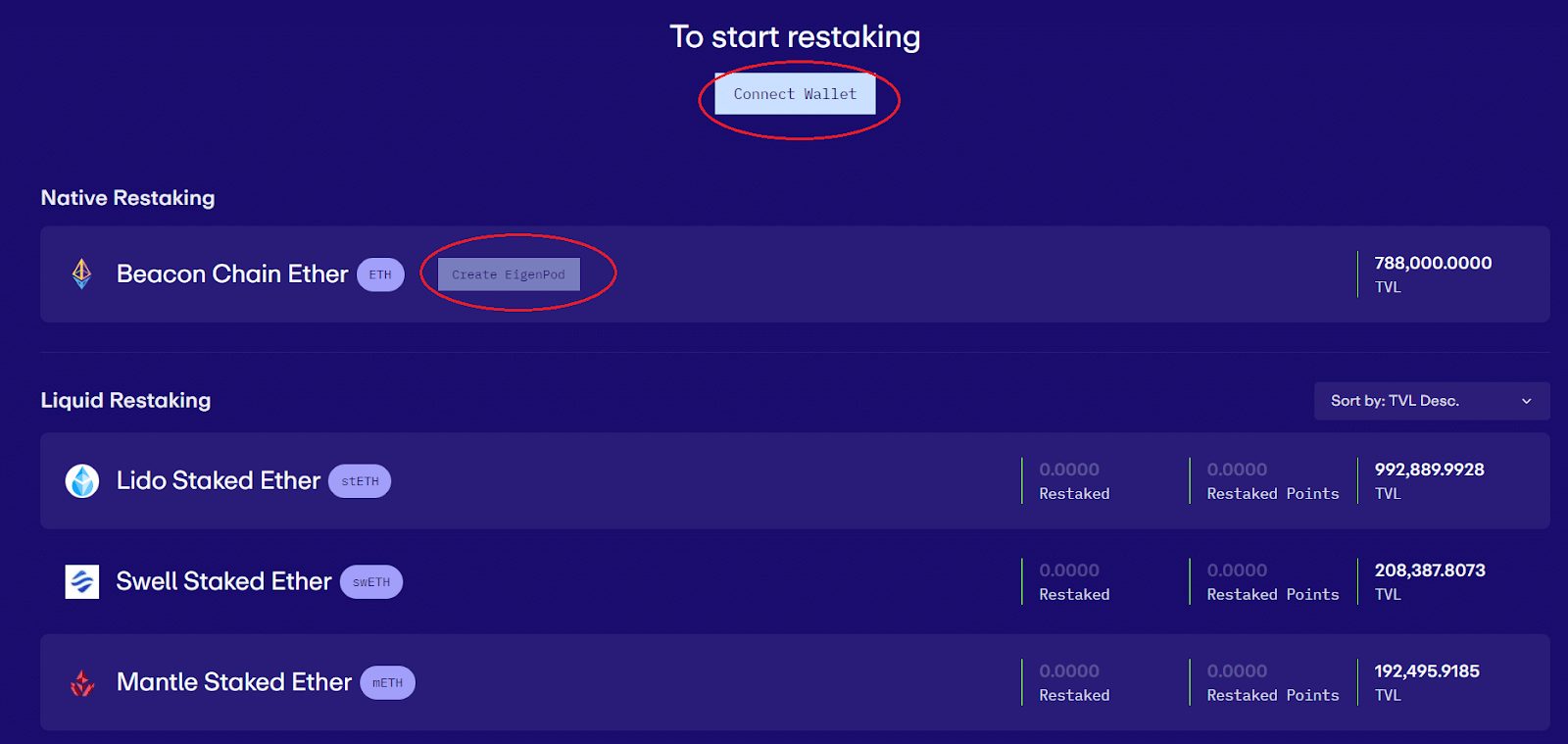

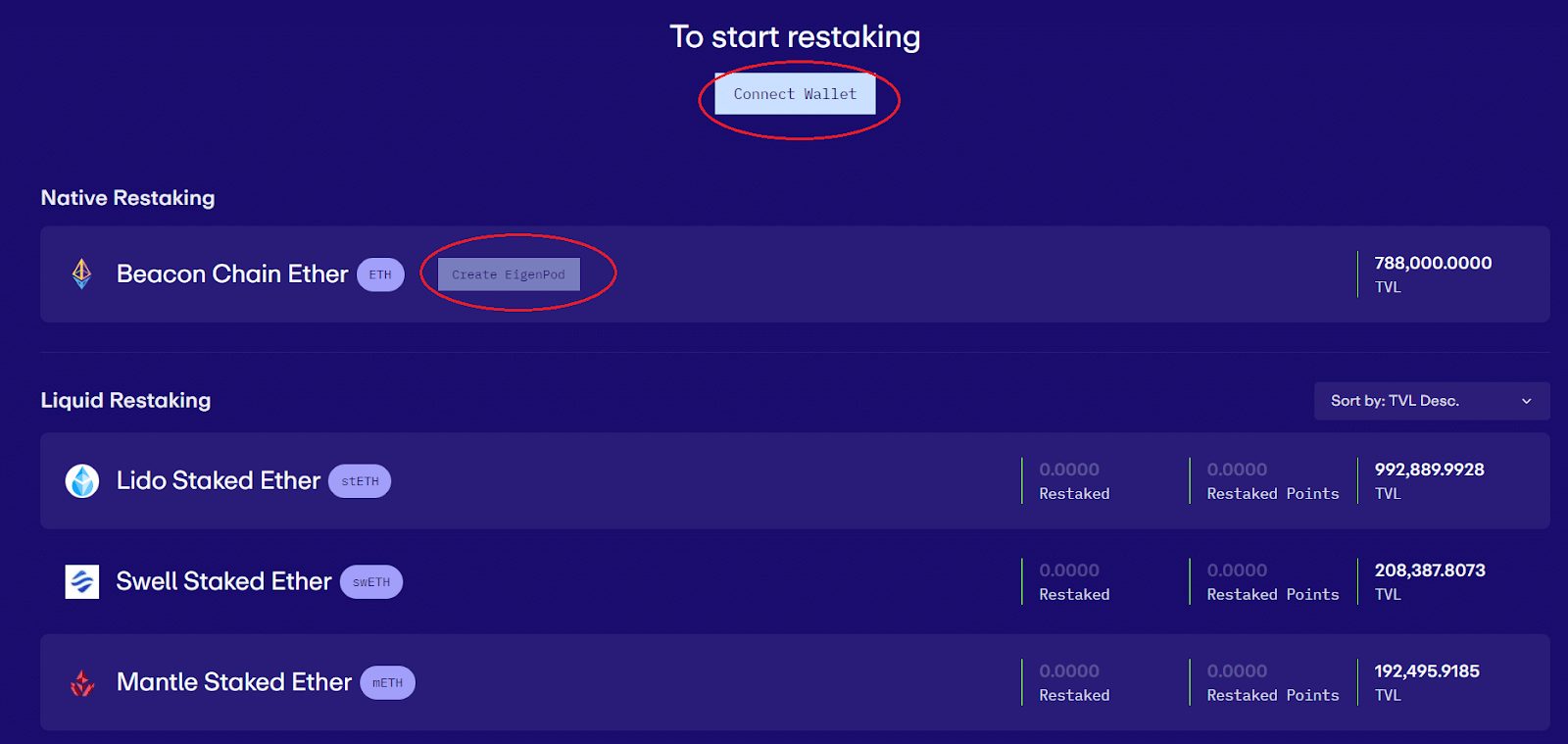

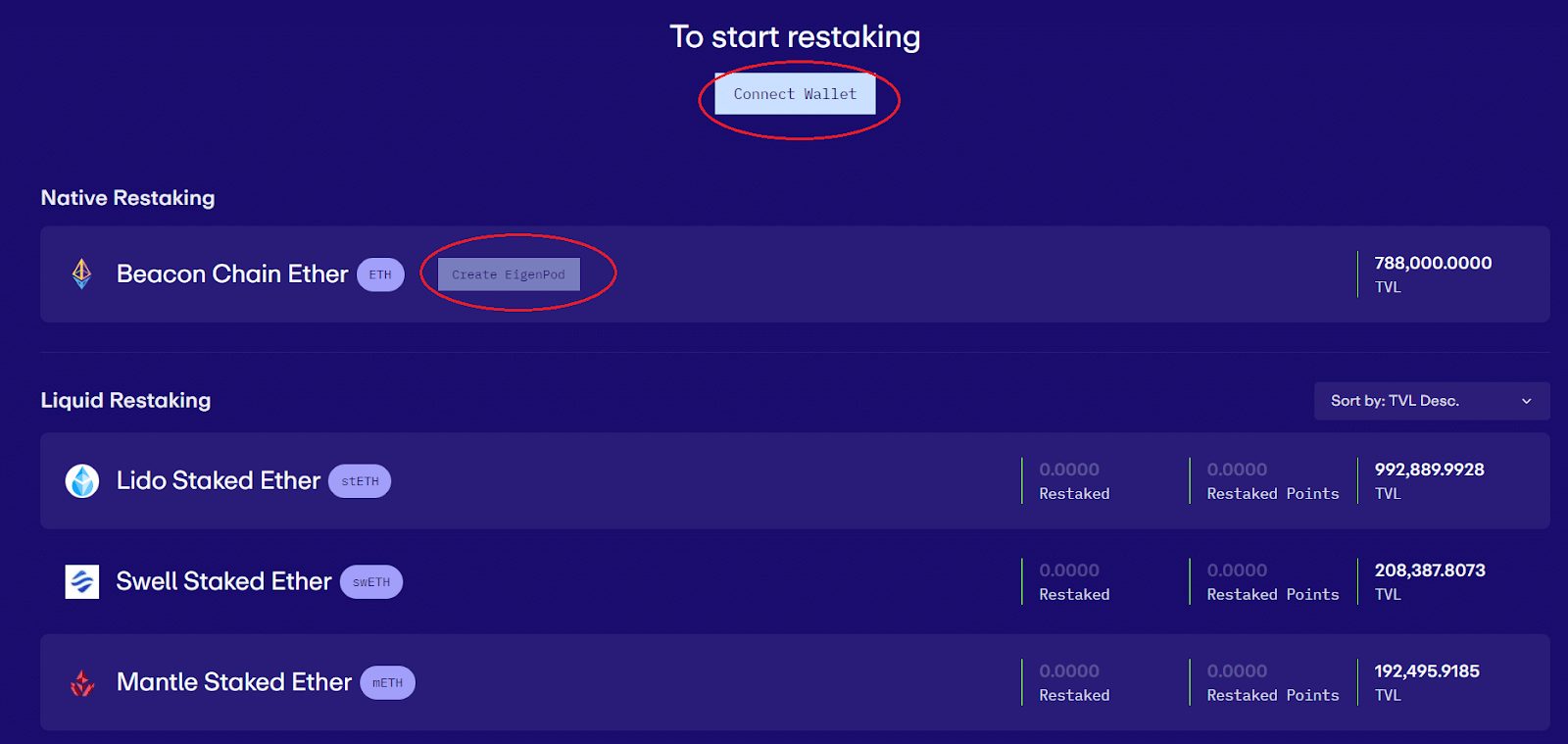

Getting Started with Restaking on EigenLayer

Here are the steps to restake with EigenLayer:

- Start by selecting the assets you want to restake, beginning with your preferred LST tokens.

- Utilize a liquid staking platform such as Lido to deposit and acquire LSTs.

- Access the EigenLayer application and link your self-custody wallet containing your LST tokens.

- Proceed with the deposit process by specifying the desired amount and confirming the transaction.

- Monitor your staking rewards and restaked ratio directly from the homepage.

- f you operate as a validator with an Ethereum node, opt for Native Restaking. This involves creating an EigenPod within the app and depositing ETH accordingly.

Restaking on Eigen Layer

Risks and Vulnerabilities

1. When you commit your ETH or LSTs for staking, you risk having them reduced if you participate in any harmful actions within a dapp. It’s possible to lose up to the entirety of your ETH, though this outcome is unlikely if you’re acting honestly.

2. If EigenLayer accumulates a significant amount of staked ETH, it could pose a systemic threat to the Ethereum ecosystem if manipulated. Users transferring their withdrawal credentials to EigenLayer also heightens the risk of centralization.

3. Users may see lower returns if more stakers seek AVS’s high yield.

4. EigenLayer collects the withdrawal credentials from Ethereum stakers. It poses a systemic risk to the main network if it’s compromised and holds a substantial amount of staked ETH.

Conclusion

In summary, EigenLayer marks a significant step forward in the Ethereum ecosystem, strengthening network security and offering new opportunities for stakers to earn rewards. Its innovative restaking feature and the implementation of services like EigenDA highlights its influence on blockchain capabilities and data accessibility. EigenLayer sets up security pools, enabling stakers to utilize their locked ETH to protect different apps, preventing costly malicious assaults. Despite speculation about a potential airdrop, EigenLayer’s true value lies in its contribution to Ethereum’s infrastructure. This is supported by a skilled team and robust funding, positioning EigenLayer as a pivotal development in blockchain technology’s ongoing evolution.

FAQs

- What are Actively Validated Services?

Systems needing distributed validation, like sidechains, data layers, virtual machines, keeper networks, oracles, bridges, cryptography schemes, and execution environments.

- How does restaking work?

Restaking automatically reinvests staking rewards back into the staking pool to compound earnings, enhancing future rewards without manual intervention.

- Are there any risks to using EigenLayer?

Risks of restaking ETH in EigenLayer include smart contract vulnerabilities, uncertain adoption, regulatory challenges, and concentration risk.