When it comes to DeFi, the year 2021 has been a continuation of the last year. DeFi apps and platforms have given a fillip to the prevalent financial system. DeFi graph didn’t take a dip for much of the previous year even while the pandemic was setting in. In February 2021, the TVL (Total Volumes Locked) for assets concluding in DeFi agreements went over $1 billion!

This is a positive vibe for the enterprises engaged in development of DeFi apps. The ecosystem is still under development and the opportunities are knocking at the door. Any enterprise that keeps tabs on the upcoming trends and takes care of the smart contract audit is set to rake the moolah.

As the money involved in DeFi projects is galloping, so are the risks. Though the blockchains themselves are decentralized and reasonably secure, smart contracts could have bugs and might be exploited. If left unchecked, this might result in fatal repercussions.

With a brief insight now into the role of smart contracts, let us gaze again on the major trends in the DeFi economy.

Usage of layer 2 solutions in Ethereum

Scalability has been an issue in Ethereum, the largest DeFi ecosystem, for long. Etherem became a victim of its own success and heavy traffic resulted in congestion of the network. Components of the Ethereum ecosystem such as decentralized exchanges (DEXs) and yield farming became inaccessible to regular users because of high fees.

A string of layer 2 solutions has been developed to resolve the problem. These solutions are about taking some interactions off the main chain to bring down congestion. For instance, smart contracts on the main chain might be handling only tasks like process deposits and withdrawals, leaving the rest to a sidechain, a layer 2 solution.

Layer 2 solutions include sidechain (independent blockchains relying on the security of mainchain), state channels (conduct interactions off the blockchain), plasma (made up of merkle trees and smart contracts), rollups (wrap transactions into a single block), and ZK-rollups (zero knowledge proof rollups using validity proofs).

Tranche lending

Emergence of tranche lending products in DeFi could bring fixed interest rates. There has been plenty of talks about tranche products, spearheaded by BarnBridge and Saffron Finance. BarnBridge’s nearly $500 million in TVL indicates the interest tranche lending products are generating.

One of the issues in DeFi lending has been the variable interest rates. On a platform, you might be earning 6% APY today. Next day, when you make up, the rate of interest you are generating could be several points more or less.

When investing in a tranche product, however, users deposit their assets into a pool with an attached fixed rate. The pool itself lends out to various lending protocols. Fixed rate on a pool means writers can be sure about the income they will be generating.

Increased popularity of DEXs

Optimized usability, deeper liquidity, and better composability has helped DEXs go stronger. 2021 is shaping up better DEXs which have a tangible edge over their centralized counterparts. The likes of Uniswap, dYdX, Balancer and Curve are fast taking the centerstage and they aren’t behind Binance or Coinbase when it comes to efficiency. In fact, they are better in many ways as users do not have to share passwords with any central repository and give custody of their assets.

Stealing of cryptocurrencies from prominent exchanges like Mt. Gox in 2014 and Quadriga in 2018 has raised questions over the security aspect in centralized exchanges.

Decentralization in DeFi exchanges makes them more secure, which is a major reason behind the rise of DEXs this year. Even on other features such as limit orders, loans, etc. DeFi-based options are becoming more sophisticated.

Emergence of other blockchains hosting DeFi solutions

For a long time, the DeFi economy was centered on Ethereum. However, other blockchains such as Binance Smart Chain (BSC) have now emerged with the ability to host DeFi solutions. This has promoted the growth of the DeFi ecosystem i.e. the number of developers and miners involved in making of the solutions and the investors/traders who have been using these solutions for various purposes.

It can be said with substantial reason that more blockchains will become the hub of DeFi solutions in the coming days, which will help in making the ecosystem even better.

Smart contract auditing – invariably associated with DeFi

As mentioned, smart contracts are an essential component of DeFi ecosystems. These are the gears DeFi works upon. However, they are also prone to bugs or hacking, making it imperative for the enterprises to get their smart contract code properly audited.

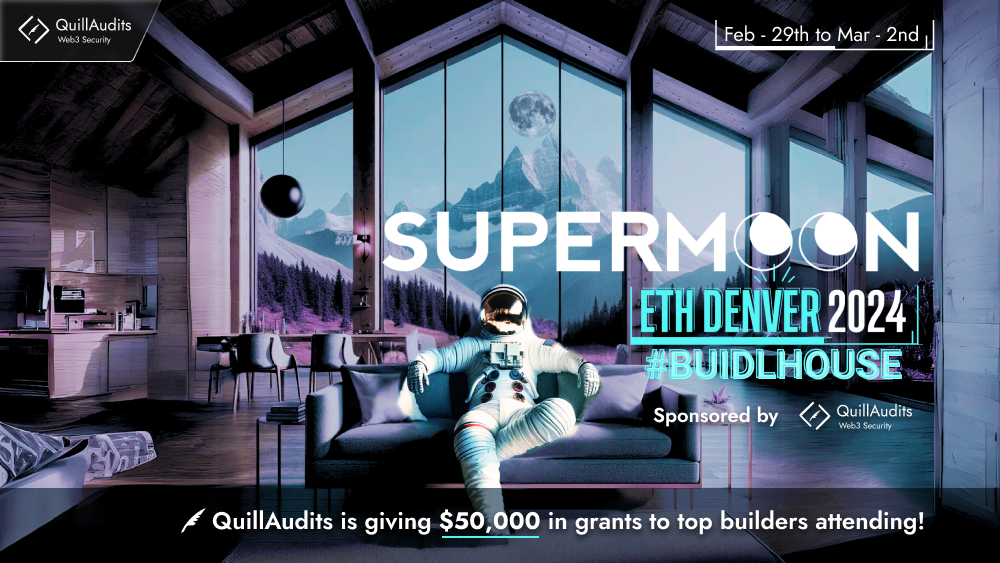

Forking is a norm in the DeFi arena. While this makes code development easier, it also means the existing bugs or vulnerabilities in the code get transferred to the new project. This again underlines the importance of smart contracts auditing from a trusted firm such as QuillAudits.

Final words

DeFi has continued to grow in 2021 and the ecosystem is gradually expanding. Usage of layer 2 solutions in Ethereum has eased congestion and has also brought down the gas costs, removing a major blockage in the enhancing usage of DeFi. Thanks to tranche lending, DeFi users can also benefit from fixed interest rates now. The year 2021 has also observed increased popularity of DEXs and the coming of the blockchains supporting DeFi projects.

A key factor among all these trends is the need of auditing of the smart contracts which act like gears of the whole ecosystem. If the smart contracts powering a project suffer from bugs or vulnerabilities, it could compromise the very existence of the project.

Reach out to QuillAudits

QuillAudits is a secure smart contract audits platform designed by QuillHash

Technologies.

It is an auditing platform that rigorously analyzes and verifies smart contracts to check for security vulnerabilities through effective manual review with static and dynamic analysis tools, gas analysers as well as simulators. Moreover, the audit process also includes extensive unit testing as well as structural analysis.

We conduct both smart contract audits and penetration tests to find potential

security vulnerabilities which might harm the platform’s integrity.

If you need any assistance in the smart contracts audit, feel free to reach out to our experts here!

To be up to date with our work, Join Our Community:-

Twitter | LinkedIn | Facebook |Telegram