Many persons are aware of this scenario, where they suffer the loss of the tokens, impermanent losses are associated with Automated Market Makers and might be seen as one of the major demerits of AMMs. Impermanent losses are explained in this article of the series, Defi: In & Out.

Impermanent Losses: The ugly face of AMMs

While the security of DeFi protocol as well as Smart Contracts is a huge concern that needs to be resolved, there are a few flaws in DeFi that are equally responsible for preventing DeFi from expanding its boundaries rapidly.

One such flaw is what we know as IMPERMANENT LOSS.

Impermanent losses explained

To begin with, Impermanent Losses are associated with Automated Market Makers and might be seen as one of the major demerits of AMMs.

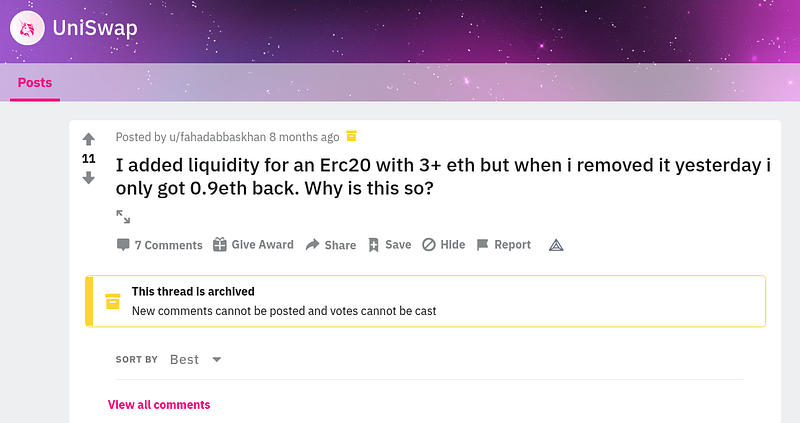

Consider a situation where instead of holding your crypto assets in your own wallet, you decide to provide liquidity to a pool but realize that you have actually lost a considerable amount of your tokens.

Well, that’s not at all a desirable scenario for any Liquidity Provider but quite unfortunately Automated market makers are susceptible to such scenarios, i.e., Impermanent Loss.

The occurrence of Impermanent Loss

Impermanent loss is the temporary loss of funds that essentially occurs due to the volatility in the price of a particular token in the pool.

In simpler terms, it’s the loss that liquidity providers face when they supply their tokens to a pool and one of the assets is comparatively more volatile than the other.

Let’s break it down to understand the mechanism effectively:

- A Liquidity provider, Bob decides to provide his crypto assets, ETH/USDT to a Uniswap pool. Since Uniswap follows a constant product market maker formula, Bob mus provide an equal value of both tokens.

- Let’s consider Bob provides 10 ETH and 10000 USDT tokens to the pool, thus locking up a total value of $20000 in the pool. (considering 1 ETH = $1000 & 1 USDT = $1).

- Now, the price of ETH suddenly goes up from $1000 to, let’s say, $2000(an extremely hypothetical scenario though ). 😃

- However, since the pool is not connected to the external world, it’s not really aware of the rise in price. This means, the pool still reflects the old price of ETH, thus creating an incredibly profitable arbitrage opportunity.

- This is where arbitrageurs play a significant role.

- Since Uniswap follows a constant product market maker formulae, in order to raise the price of ETH in the pool(to match the actual price of $2000), the quantity of ETH must decrease.

- Hence arbitrageurs simply buy the cheap ETH from the pool. In order to match the actual price of ETH, they take 5 ETH from the pool and provide 5000 USDT.

- Now the pool has 15000 USDT and 5 ETH and the total value locked becomes $25000.

- However, if BOB didn’t provide liquidity to the pool and simply kept the asset in his own wallet, he would have had a total value of $30000 after the rise in ETH price.

10000 USDT + 10 ETH * $2000 = $30000

- Therefore, although there is an extensive rise in the price of ETH, Bob faces an Impermanent loss of $5000.

The Impermanent Nature of the Loss

The loss is impermanent because Bob has not withdrawn his liquidity yet and there is a possibility for the price to be stable again and losses go back to 0.

However, if he withdraws the liquidity at this point, the loss of $5000 becomes Permanent.

Battling against Impermanent Losses

Impermanent losses are indeed an extremely troublesome scenario. The bigger the price change or volatility of an asset, the higher the chances of impermanent losses.

Various DeFi protocols have now started addressing the Impermanent loss issue and are coming up with different solutions to mitigate the losses of Liquidity Providers.

Bancor claims to have effectively solved the problem by compensating the liquidity providers with BNT tokens to cover their losses due to impermanent loss.

However, some of the most renowned personalities in the DeFi world like Hayden Adams, the creator of Uniswap, firmly believe that we are still far from an adequate solution that effectively solves the impermanent loss issue.

Defi has been expanding its boundaries with an incredibly rapid speed and it’s now more imperative than ever to gain a better and effective understanding of the Decentralized finance ecosystem.

However, there is no denying the fact that DeFi not only comes up with new terminologies frequently but also becomes vulnerable to new attack patterns.

Therefore, in order to stay ahead of the curve, it’s very crucial to keep a sharp eye on any such DeFi events or terms.

Well, this DeFi Security and Awareness series help you exactly with that.

Get started with this Defi series and gain a better understanding of the DeFi ecosystem.

Parts of this series:

QuillAudits is accomplished in smart contract audits and security solutions to different industries including DeFi enterprises. Click below to book a free consultation session with QuillAudits

Follow us:

Twitter | LinkedIn | Facebook