The competition for layer-1 blockchains is growing strong with new emerging solutions improvised in terms of cost, speed, security and scalability from the existing ones.

Although there are many new entrants, Ethereum remains indispensable in the smart contract space.

Therefore, competitors embrace Ethereum’s wide adoption and build solutions by bridging the Ethereum network.

Solana and Avalanche are many of the few blockchains built with EVM compatibility and have a growing market share of 4% and 5%, respectively.

In that way, a relatively new protocol NEAR launched in 2020 paced up its growth, raising its market cap value to $10B+ within a year.

Near protocol received substantial venture support and gained $33 million in the initial token distribution from the 12% of its 1 billion total token supply.

The impressive lucrativeness brought us to analyse the virtues of the Near protocol in this article. Let’s dive deep and understand its underlying technicalities.

What Is Near Protocol?

Near protocol was built from the ground up by Polosukhin and Alexander Skidanov. Its main highlight is that it supports languages compiling WebAssembly, such as Java, Go, Rust, etc. However, Rust is the most preferred language of Near programmers.

That makes Near protocol Web2 developer-friendly, unlike coding Ethereum contracts that require the learning of Solidity language.

Near works on a threshold proof-of-stake consensus which allocates staking rewards to its validators and stakers based on the staked Near with a particular shard.

The design of the Near protocol employs the concept of sharding, where the network’s infrastructure is split into several segments, called nodes. Each node deals with only a fraction of transactions on the network.

Sharding effectuates the distribution of blockchain segments to the nodes instead of the complete blockchain. This accounts for the efficient retrieval of data and the scalability of Dapps since it stores only a portion of the platform’s data. (More details in the upcoming passage)

Near’s block production follows the “DoomSlug” technique. “DoomSlug” helps Near to achieve the finality of blockchain transactions with just one round of communication across the nodes.

In addition, 50% of the participants are required to finalize blocks, contrary to 66% needed by the Byzantine Fault Tolerance(BFT) consensus algorithm, which underlies Ethereum and other networks.

Timeline of Near Protocol

Aug’2018 – Polosukhin and Skidanov joined to create a scalable, fully sharded, permissionless blockchain.

April’2020 – Mainnet Phase 0: Launched the network operating on Proof Of Authority(POA) consensus (the dev team operates nodes).

Sept’2020 – Mainnet Phase 1: Onboarding of third-party validators for attesting transactions on Near network.

Oct’2020 – Governance rights to the community with feature implementations such as token transfers and protocol rewards.

April’2021 – Rainbow bridge development to link Ethereum and Near blockchains.

Architecture Of Near Protocol

Nightshade For Near Operation

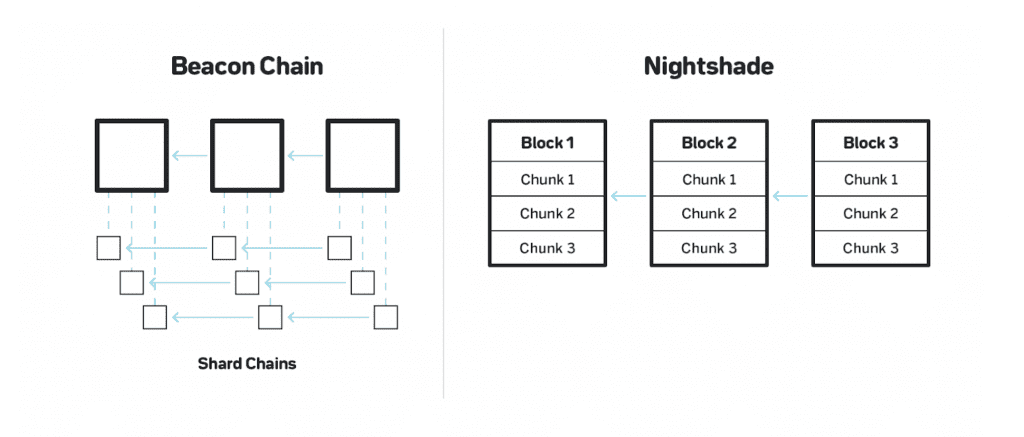

Nodes are the functional elements of processing transactions, distributing and storing the data in the blockchain. Generally, blockchain technology puts all the nodes to process transactions and store the chain’s history.

The drawback of this is the low speed because of the time it takes for all the nodes to be updated. Whereas Near blockchain leverages the method of Sharding, which breaks the history into small pieces of data that are stored by different participants in the network.

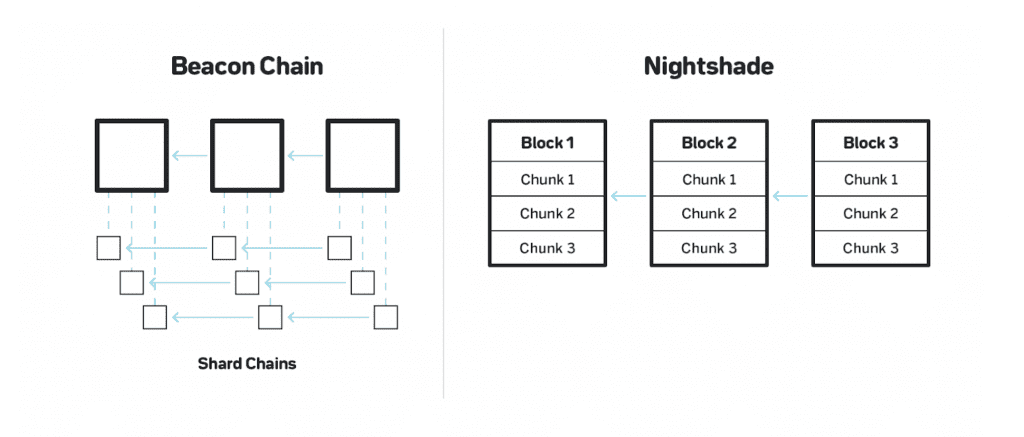

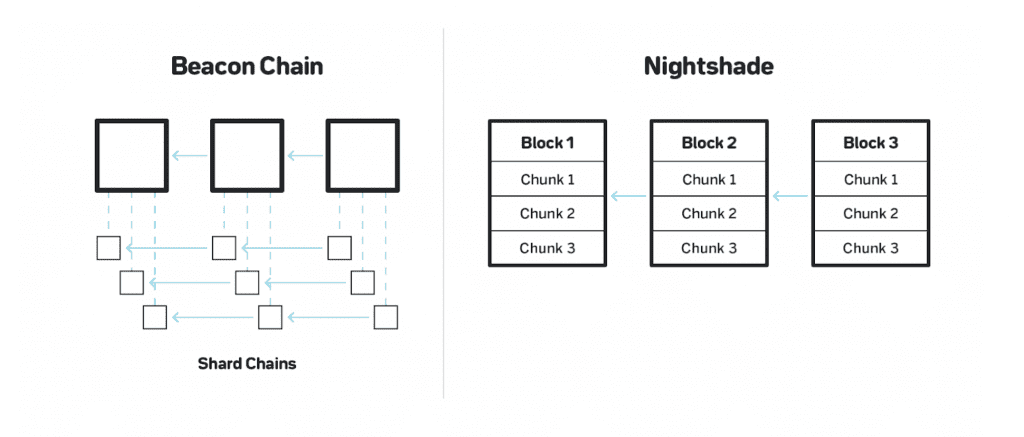

For this, Near uses a sharding technology called NightShade. It allows Near protocol to maintain a single data chain by sharding individual blocks. The shard produces its portion of data called “chunks” handled by the nodes.

Each block of the network contains the header of the chunks, which acts as the metadata that reveals the information about the chunk.

This way, the load storage and processing are distributed across multiple nodes, improving network speed and scalability. However, it also raises concerns about the security of the individual shard.

Because each shard has few validators, it renders bad actors a chance to perform an attack. Near follows a novel approach of tolerating up to ⅔ of bad actors before any compromise occurs on the network.

At present, 100 validator seats secure the network by validating the chunks. There’s an interesting update from the Near team regarding the Validator nodes. Read on to know about the updates in store for the Near protocol.

Compatibility Brought By Aurora

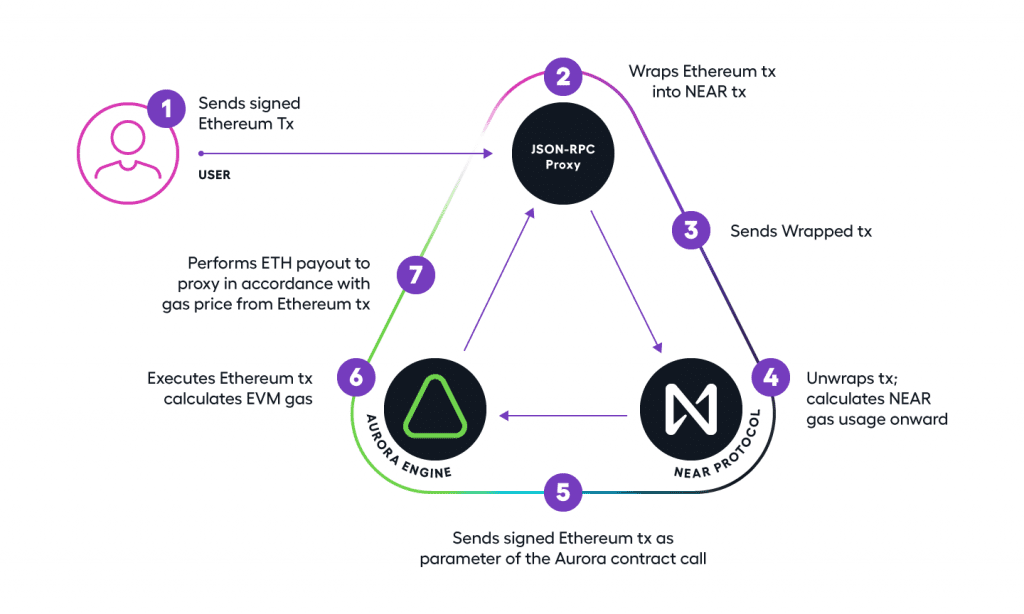

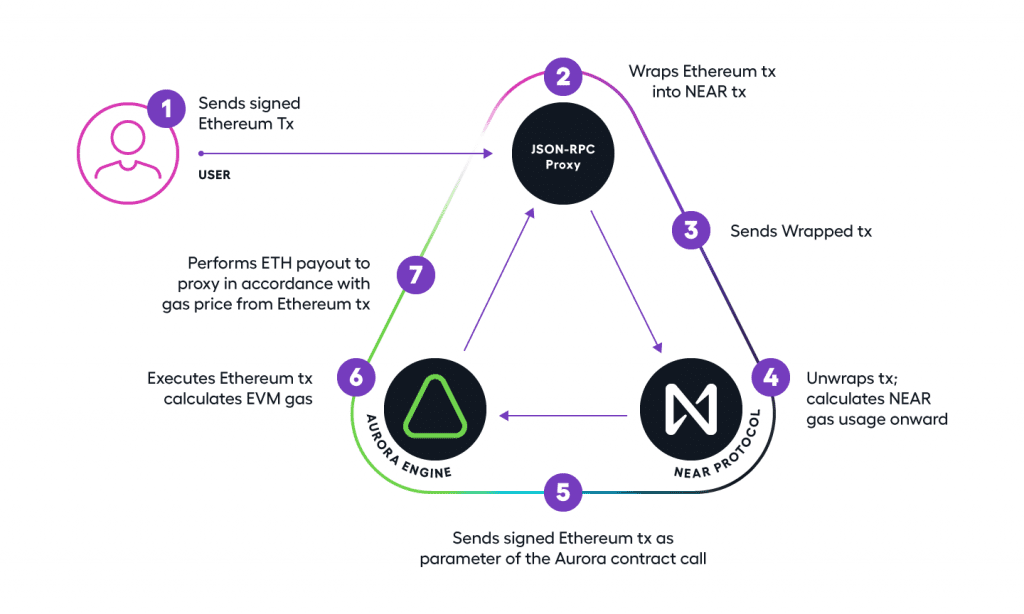

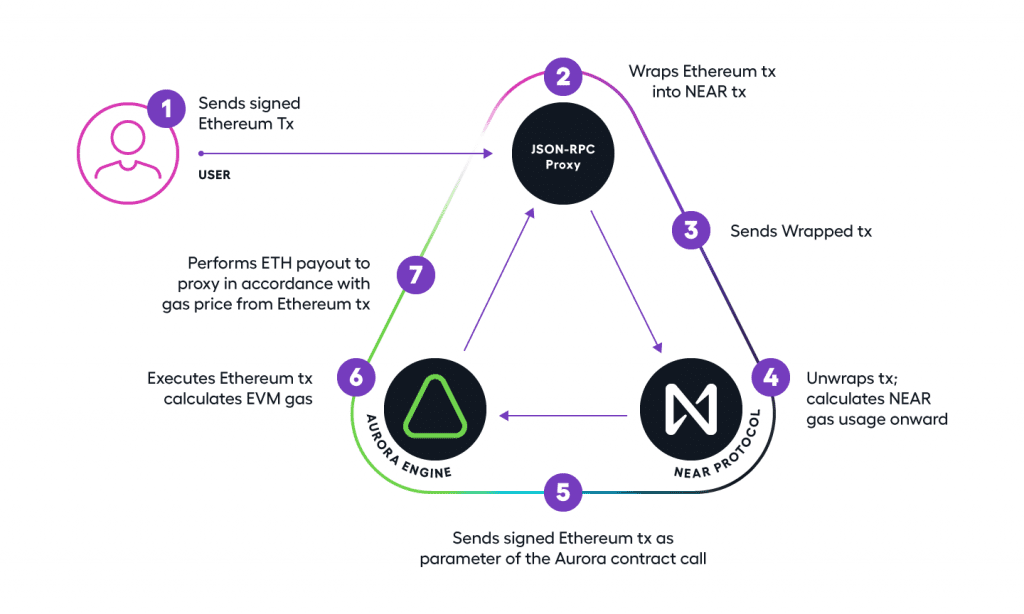

Near blockchain offers compatibility for Ethereum virtual machine (EVM) for easy access to Ethereum developers to port applications. It brings forth EVM compatibility by deploying the smart contract on the main network called Aurora.

Aurora is a layer-2 solution that runs as a side chain while inheriting the block time and consensus mechanism from the NEAR network. It acts as its stand-alone network providing users with the advantage of high throughput, low fees and familiarity of Ethereum applications.

Bridge Facilitating Cross-Chain Transfers

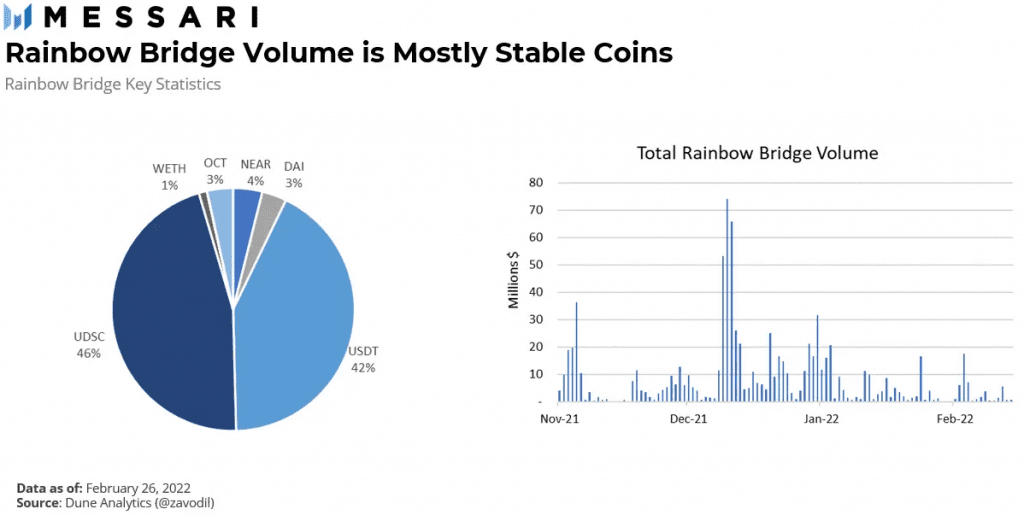

Near has bridges to facilitate the transfer of assets through other ecosystems like Ethereum, Terra, and Cardano.

Rainbow Bridge is for the Ethereum network that allows the network participants to transfer Ethereum tokens between Near and Ethereum. Currently, Rainbow bridge is the most popular, with almost $750M in Total Value Locked(TVL).

To move tokens from Ethereum to Near, users can deposit them in the Ethereum smart contracts, which are locked in the contracts. These tokens are minted on Near’s platform representing the Ethereum tokens. However, the original funds can be retrieved whenever the user wishes.

AllBridge and CBridge are other bridges connecting to the Near network.

NEAR Tokens

NEAR launched 1 billion tokens, and about 35% of existing Near tokens are currently staked for running a validator. The circulating supply of the token had increased by 400% after its launch in 2020, when tokens started unlocking.

The token supply is expected to stay flat by the end of 2022, after which the token supply is essentially only the staking rewards.

The main use-cases of the Near token are,

- Staking for running validator node

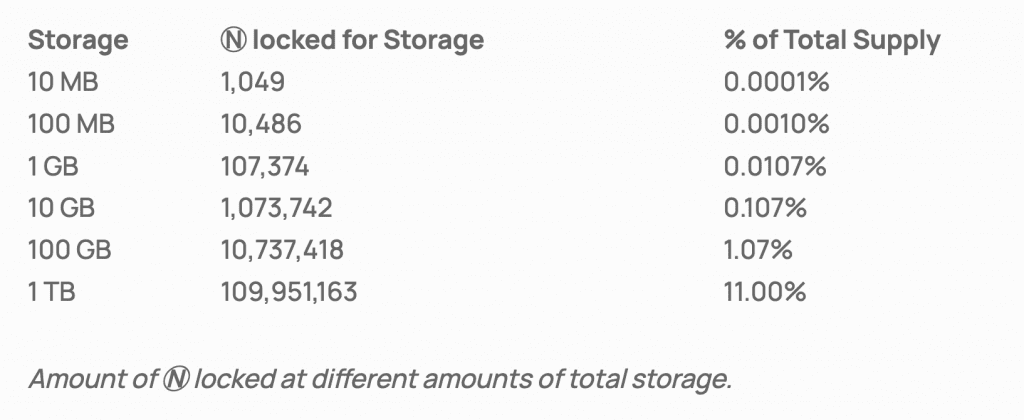

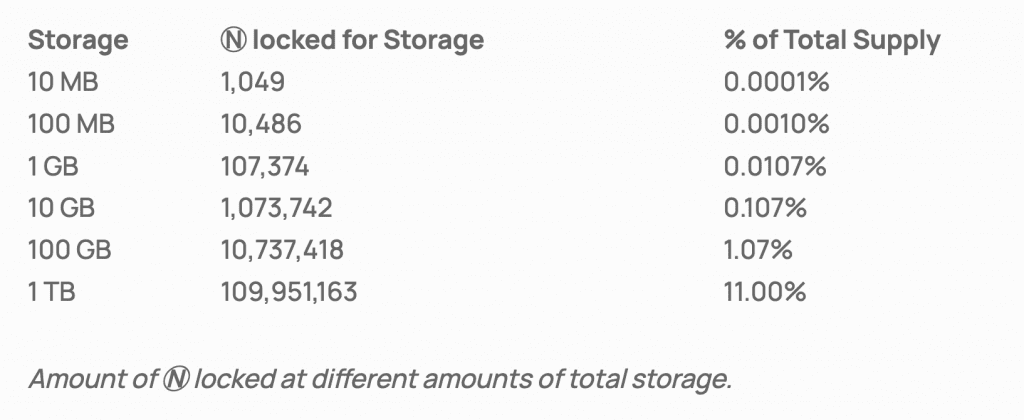

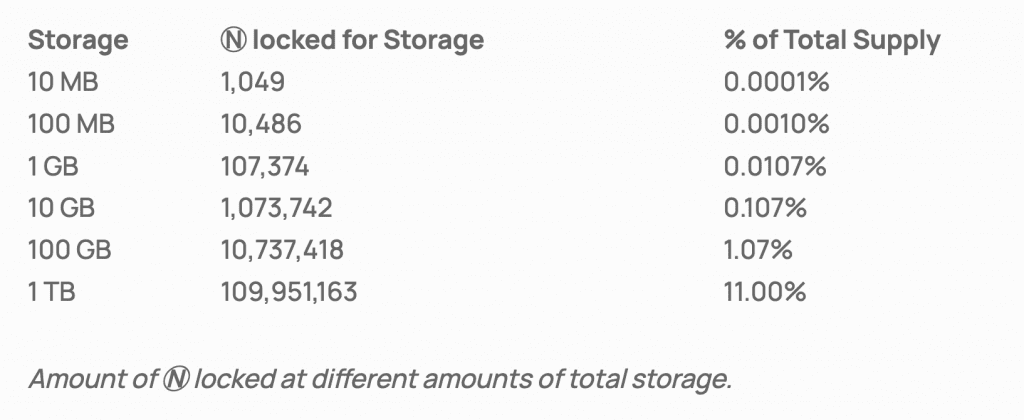

- Paying transaction and storage fee

- Medium of exchange

The Near Protocol Ecosystem

The Near ecosystem has rapidly grown in two years, with over 350 more projects added every day between Near and Aurora. Its developer-friendly features empower businesses and communities to explore new areas.

The new projects lining up in the space highlight the importance of auditing for secure implementation by balancing the inefficiencies in the functioning and identifying the loopholes in the smart contract code.

- DeFi

Near is making DeFi more accessible to the users and holds much potential for new additions.

The popular Decentralized exchanges are Ref Finance (NEAR), taking up to 19% of TVL and Trisolaris (Aurora), corresponding to 56% of TVL. Altogether the DeFi protocols hold $600 million in total value locked.

- Non-fungible tokens

The low transaction costs on Near protocol flourishes the familiarity of NFTs and gaming. Although gaming is in the initial stages, the Web3 gaming studios have raised millions to actuate the launch of games in 2022.

Near Protocol Updates In Line

- The team has planned to increase the number of validators in 2022. The Near tokens required for becoming a validator depend on the number of people staking on a particular shard.

- Dynamic re-sharding is expected to be implemented by 2022, in which the network and the number of shards scale as per the arising user demands.

- Near has partnered with the Octopus network to allow developers to launch “app chains” with specific use cases that work in parallel with the main chain.

- Use DAOs and Guilds to hand over the governance power to the community in the future upgrade.

Why Is It Necessary To Take Up Auditing For Near Protocol?

Near protocol is an emerging network that employs a wide range of programming tools and smart contracts with cross-chain compatibility for the deployment of Dapps.

Minor technical loopholes can result in hefty losses, which can be prevented by approaching trustworthy auditing firms like QuillAudits.

The comprehensive analysis performed by our experts through manual and automated tools ensures the secure implementation of projects free from any coding bugs.

Furthermore, we inculcate techniques like fuzzing that help our Near protocol security audit expert analyse the unexpected code behaviour and provide the observed study in the audit report.

Reach out to QuillAudits for more details.

FAQs

Is Near protocol a blockchain?

Near protocol is a layer-1 blockchain solution with developer-friendly features for creating Dapps on the network.

Is Near protocol worth investing in?

The statistics of the Near protocol show the growth potential, and experts also show a positive sign for investments. However, the crypto market is highly volatile, and fluctuation in the token price is unavoidable.

What does Near protocol aim to solve?

The concept of sharding helps in the distribution of load storage and processing across multiple nodes, which improves network speed and scalability.

What is a Near token?

NEAR launched 1 billion tokens, and about 35% of existing Near tokens are currently staked for running a validator. The circulating supply of the token had increased by 400% after its launch in 2020, when tokens started unlocking.