There is no denial in the fact that Decentralized Finance(DeFi) has been one of those fields that are rapidly expanding its boundaries in Blockchain. Since the day DeFi came into existence, it has been wiping-out single authority control and third-party interference in financial transactions with the help of Smart Contracts as well as Blockchain. It is, in fact, this decentralized and permissionless nature of DeFi that has shifted it to the zenith of its glory.

However, at this point, a very interesting question might grab your attention.

If DeFi doesn’t support individual authority control, who is supposed to take the future decisions for the DeFi protocols?

The answer is the DeFi Governance Model.

What is Decentralized Finance (DeFi) Governance Model?

The DeFi governance model rigorously intends to move the control and administration of a protocol from one entity or group to the users of the protocol.

At the heart of this model lies the Governance Tokens. These tokens allow DeFi to ensure an adequate decentralized governance mechanism of any particular protocol.

What exactly is a Governance Token?

Governance tokens are, to begin with, an exploratory strategy that has gained considerable attention in decentralized finance.

In any DeFi platform, governance tokens play a groundbreaking role in setting up a democratic governance model. This enables the holders of the governance token to engage in that specific protocol as well as impact the decision-making mechanism.

One of the most notable usages for governance tokens is for an appropriate voting mechanism that grants holders the ability to vote for or against a specific proposal. This ensures that any proposal or decision taken for the protocol must be approved by the majority of the users.

Alright, let’s discuss the governance token distribution mechanism.

If observed thoroughly, the majority of the defi protocols utilize a standard distribution model. According to this model, the users receive governance tokens whenever they participate in the protocol.

Let’s take an example to understand the process of governance tokens distribution in an effective manner.

Every day, Compound distributes approximately 2890 COMP tokens to its users. These are users who actively participate in the protocol. They may be the ones who provide liquidity to the protocol or interact with the platform as a borrower.

Hurdles in the path of the DeFi Governance Model

The DeFi governance paradigm is still fraught with certain defects, bearing in mind the fact that the entire DeFi ecosystem is still in its developmental phase.

Uneven Distribution of Power:

To begin with, the very first obstacle faced by this paradigm is the aggregation of governance tokens within the hands of a few early users of the protocol.

For reference, almost 46 percent of the overall governance tokens (COMP) were held by the owners, shareholders and the Compound team during the distribution of Compound COMP tokens. It illustrates very clearly how the Compound protocol builders themselves regulate the most of the voting power and the are quite capable of manipulating the entire voting procedure. While speaking about other protocols, 24% of the entire Maker Dao’s governance tokens(MKR) are primarily controlled by the top 20 addresses.

The Vicious side of Yield Farming:

While yield farming ensures incredible high returns, it has an ugly face as well.

Careful observation will lead us to the fact that excessive practice of yield farming technically blurs the actual value of the associated crypto assets. One of the most crucial reasons behind this is the fact that due to such practices, the demand for a particular asset increase enormously. Additionally, this rise in demand is, usually, for a very short period.

This adds to a potentially problematic situation where it is exceptionally challenging for the borrowers to pay repay the debt.is While this will cause a substantial loss in the value of a specific governance token, the stability of a defi protocol is also affected.

Parts of this series:

- Flash loan attack explained | Part1 | DeFi: In & Out

- Impermanent losses explained | Part2 | DeFi: In & Out

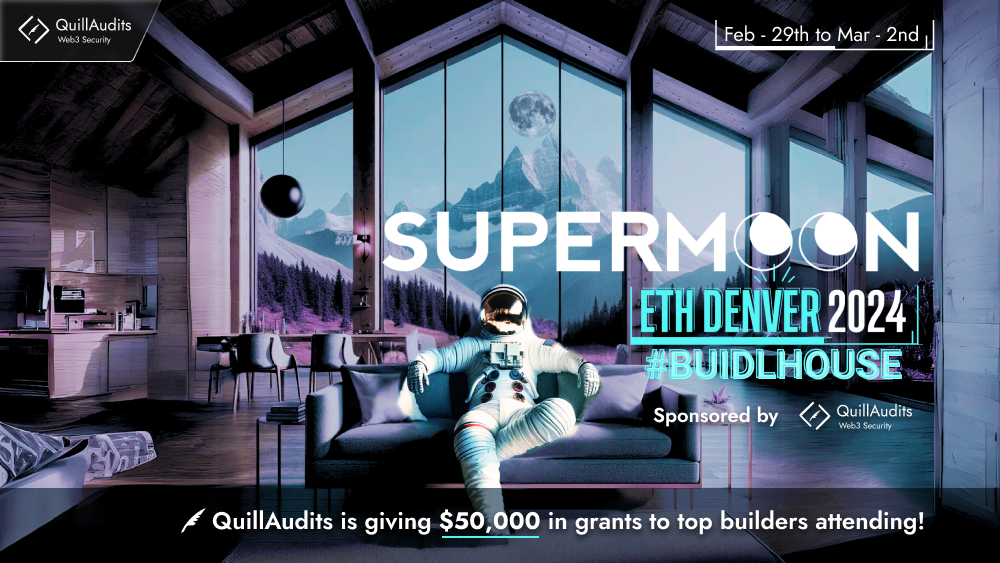

QuillAudits is accomplished in smart contract audits and security solutions to different industries including DeFi enterprises. Click below to book a free consultation session with QuillAudits.

Follow us:

Twitter | LinkedIn | Facebook