According to Binance research, as of August 2023, Telegram trading bots have been orchestrating transactions worth a staggering $283M.

It’s a sum that might get you curious, but the question is: how did these bots suddenly find themselves in the crypto-verse spotlight?

The story unfolds with trading bots like Maestro and UNIBOT igniting a FOMO(Fear of missing out) in the crypto market. This trading bot-driven frenzy witnessed $UNIBOT’s market cap ascend from a humble $30M to an eye-popping $185M, with its user count steadily growing since its inception in May.

And Maestro, the largest trading bot by volume, has generated an astonishing $14.7 million in fee revenue alone since April.

With a global Telegram user base of 800M, the custodial service has already seen over 3M registered users.

The question that looms on the horizon, though, is: what are these crypto trading bots, and what purpose do they serve? Does it come without its own risk?

Let’s paint a clear picture of all these questions in this article.

What exactly are these crypto trading bots?

The Telegram trading bots, or TTBs, are essentially trading interfaces housed within Telegram, a messaging app that’s already quite a hit within the crypto community.

You’re scrolling through your Telegram chat, and right there, in a single chat window, you have the power to buy and sell cryptocurrencies directly on the blockchain. There is no need to navigate complex websites or decipher intricate trading platforms, as TTB makes it all simplified and user-friendly.

Furthermore, these bots come equipped with various powerful tools and features. With this, you can use shortcuts for lightning-fast transactions, implement predefined strategies to automate your trades, and even harness features like MEV (Maximal Extractable Value) and front-running protection to give you a competitive edge in the market.

Telegram Trading Bots: Long story short

In July 2023, Telegram took a significant step towards crypto integration by introducing the Telegram Wallet bot. This innovative bot allowed Telegram users to conveniently buy and sell cryptocurrencies right within the messaging app.

What made it even more intriguing was the launch of the Wallet Pay service, which served as a custodial solution for processing crypto payments through Telegram. This service was built on the TON blockchain, signalling a bright future for crypto integration within the Telegram ecosystem.

Fast forward to September 2023, a month that would mark a turning point. During the Token2049 crypto conference, Telegram and the TON Foundation jointly announced the launch of the self-custodial wallet, TON Space.

It’s designed as an extension of the Telegram Wallet bot, offering users even more control and independence in managing their digital assets.

TON Space’s introduction into the Telegram ecosystem couldn’t have come at a better time. This is precisely when a new type of crypto activity was gaining prominence among Web3-oriented Telegram users – trading bots.

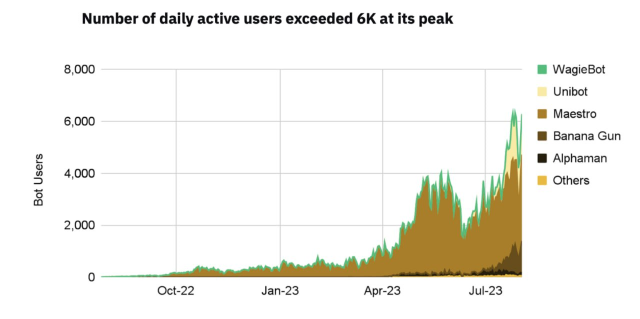

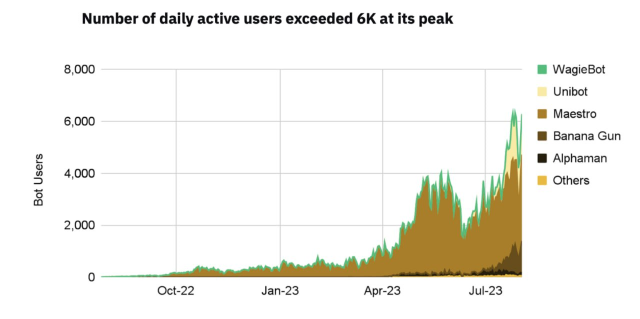

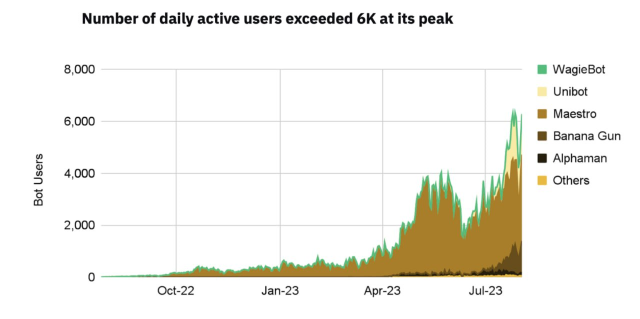

Number of users for Telegram Bots steadily increased

How have Telegram Bots become the go-to choice for DEX Traders’?

It’s all about speed, convenience, and innovation.

These bots offer you strategies that were once the exclusive domain of experts. You can “snipe” new tokens, set limits, and follow the moves of successful traders, all at your fingertips.

With a few taps on your phone, you’re in the game—no need for complicated wallet setups. Telegram bots make it quick and effortless.

So, this gets us to know what functionalities Telegram Bots possess.

The varied capabilities that Telegram Bots possess

These bots offer a range of functionalities that simplify and enhance the way you interact with the crypto market, such as:

1. Efficient Token Trading: You can swiftly purchase tokens by sharing the contract address in the chat, and most bots provide real-time updates on your trade’s performance. Selling is just as convenient, with pre-approved and signed transactions.

2. Stop Loss and Take Profit Orders: You don’t have to be glued to your screen anymore. Set stop loss and take profit orders, and the bot will automatically execute trades when the token hits your specified price. This hands-off approach lets you automate your trading even when you’re offline.

3. Scam checking: One of the biggest fears in crypto is rug-pulling, where token developers suddenly pull liquidity. Telegram bots have your back. They detect pending rug-pull transactions in the mempool and execute a swift sell to protect your investment.

4. Copy Trading: Why not “copy the pros”? Telegram trading bots allow you to follow the trading moves of successful traders by replicating their transactions and trades. It’s like having your very own crypto mentor.

Speed vs. Security: Telegram Trading Bots and the Trade-off

To achieve a level of unparalleled efficiency, these bots are equipped to sign transactions on behalf of traders. But for this, the traders are required to share their private keys with the Telegram bot during wallet setup. This is done by importing their private keys or pre-funding a wallet created by the bot.

While this setup enables bots to execute trades easily, it also means that the bot gains the power to move a trader’s funds as it sees fit. In essence, users must place trust in these bots, hoping they won’t misuse their assets.

This trust becomes a significant concern because most Telegram trading bots don’t provide audit reports or access to open-source codebases or detailed documentation.

Next is the speed in executing trades, which may also come at a cost. Unlike aggregators seeking optimal rates by querying multiple liquidity sources, speed-focused bots tend to limit the number of liquidity sources they interact with to reduce the time it takes to discover the most efficient route. This trade-off often results in shallower market depth, especially when dealing with less common tokens.

Shallower market depth increases the risk of executing trades at suboptimal rates, and that’s where the extremely high default slippage tolerance recommended by these bots becomes a critical factor. Notably, with slippage configurations starting at 5% or higher, such trades also become vulnerable to front-running attacks.

Furthermore, the simplicity of the chatbot interface, while making trading accessible, conceals crucial trade information and safeguards that could prevent unintended trades. When traders use these bots, they essentially submit a blind market order with no confirmation prompts or actions. Given the rapid pace of these trades, any mistakes made during trade setup could result in immediate losses.

In this trade-off between speed and security, Telegram trading bots raise important questions about the safety of using these bots.

How to Use Telegram Bots for DEX Trading Safely?

- Before trusting a bot, research the developer’s reputation, reviews, and presence on social media.

- Understand fees, risks, and limitations by carefully reviewing the bot’s terms and conditions.

- Experiment with a separate wallet containing a small amount of funds, keeping your main wallet’s private key safe.

- Monitor your bot’s activity regularly and set up alerts or stop-loss measures for added security.

- Be aware of market trends, avoiding chasing quick gains and falling for scams.

In conclusion,

Telegram trading bots have made a splash with significant market capitalization and fast trading capabilities. To leverage their benefits, users must exercise caution, conduct due diligence, and follow security best practices. Whether they’re your crypto’s best friend or a risky gamble ultimately hinges on how wisely you use them.