The success of every DeFi protocol is closely related to how well audited it is. A simple developer oversight is enough to sink a project. The need for smart contract audits can not be overemphasized. But what exactly is a smart contract audit?

“A smart contract audit is an extensive, methodical examination and analysis of a smart contract’s code that is used to interact with a cryptocurrency or blockchain.”

Coinmarketcap

Since DeFi involves employing smart contracts to perform transactions without a third party, smart contract audits are practices that check for bugs, errors, and security vulnerabilities in the codebase, intending to suggest improvements and ways to fix them. For a proper audit, auditors and developers are required to pay attention to certain details.

Approaches to smart contract audit

Meanwhile, there are manual and automated approaches to employ in DeFi smart contract audit. Manual auditing refers to using independent teams to look for bugs and security issues to prove it is secured. On the other hand, automated auditing leverages software to analyze and the codebase for vulnerability.

Whatever the approach, there are various steps to auditing a DeFi smart contract. These include assessment, verification, testing, and reporting. The measures, if duly followed, safeguard a DeFI protocol against possible vulnerabilities; however, they are iterative.

Cost of smart contract vulnerability

Frequently, smart contract vulnerability where fraudsters or hackers exploit or manipulate the codebase opens doors to loss of funds and digital assets in a DeFi protocol. That said, the solution is a thorough DeFi smart contract audit. DeFi actors should pay attention to smart contract audits to avoid sinking their projects and scaring investors. Recall that CipherTrace August reports highlight that 76% of crypto hacks this year are a DeFI attack.

Why conduct a smart contract audit

Having seen the rising DeFi exploits, heist, and hacks, one could ask if DeFi is a blessing or a curse. Safety requires due diligence in smart contract deployment.

Apart from losing funds and sinking a DeFi project, an unaudited DeFi smart contract is a red flag for investors. Performing a DeFi smart contract increases the project’s rating, increasing investor confidence in a protocol. No sane investor would like to participate in an unaudited ICO, IDO, or whatsoever. Auditing a DeFi smart contract beckons to be very important for running a successful protocol.

Also Trending: ILO vs. IDO and – Need for Auditing before going onto these Platforms

What you must look for in a DeFi smart contract audit

Now that you must get your DeFi smart contract audited let us proceed to things you must look out for in a smart contract audit. As an auditor or project owner, this will help you check if a DeFi smart contract is adequately audited.

Identify risks and vulnerabilities

After smart contract development, it is best practice to initiate processes to identify possible risks and vulnerabilities. This process seeks to test and run checks on the codebase. Running an audit includes simulating an attack to check for operational, technical, and cyber risks in the smart contract. Auditors examine whether executing a contract faces any vulnerabilities while fulfilling the agreements the stakeholders had agreed upon.

Improve codebase

Auditors need to deploy an innovative approach on every project to analyze the quality of the code. A thoroughly audited DeFi smart contract comes with a report that shows how secure the contract is. The reports show the possible point of failures on the codebase, creating room for code improvements. Best practices demand that the code be improved after the report is examined and testing it again for similar or any other vulnerabilities.

Lack of appropriate coding skills 👨💻 is- “𝗼𝗻𝗲 𝗼𝗳 𝘁𝗵𝗲 𝗽𝗿𝗼𝗺𝗶𝗻𝗲𝗻𝘁 𝗿𝗲𝗮𝘀𝗼𝗻𝘀 𝗯𝗲𝗵𝗶𝗻𝗱 𝗗𝗲𝗙𝗶 𝗵𝗮𝗰𝗸𝘀!”

— QuillAudits (@QuillAudits) August 25, 2021

More than 𝟭𝟬𝟬 DeFi projects were exploited for $𝟱𝟬𝟬𝗠 due to “coding errors” in the recent past.

[1/4] pic.twitter.com/CkSVRylwwu

Determine code specifications

Every program has its standards and codes. The same is applicable with smart contract languages like Solidity, Rust, Golang, etc. Though developers and designers need to conform to IDE, compiler, and return calls standards, there could be errors along the way. Auditors need to look out for possible codebase specification errors, including but not limited to compiler warning, compiler version, event standards, return standards, etc.

Ensure code security

Every code is prone to attack, so it is necessary to check the code base for possible security issues. Auditors are encouraged to study the security architecture of the contract to avoid vulnerabilities such as replay attacks which involve the demands for entrusted management that often lead to replay attacks. Permission control and call injection are good security checks because when permission settings and call controls are not guided, it could lead to an attack. Auditors should also pay attention to issues like value overflow, arithmetic overflow, and reentrancy.

Wrapping up

Smart contract bugs are a threat big enough to sink a project and deter investors. Bugs, vulnerabilities, or hacks could result from third-party interference, business logic errors, coding mistakes, developers’ incompetence, among others. To run a successful DeFi protocol, developers must perform a DeFi smart contract audit. For full-fledged audits, security experts should have checklists that follow best practices to make their work easy and prevent specific errors such as specifications, design parameters, and security architecture, including control measures.

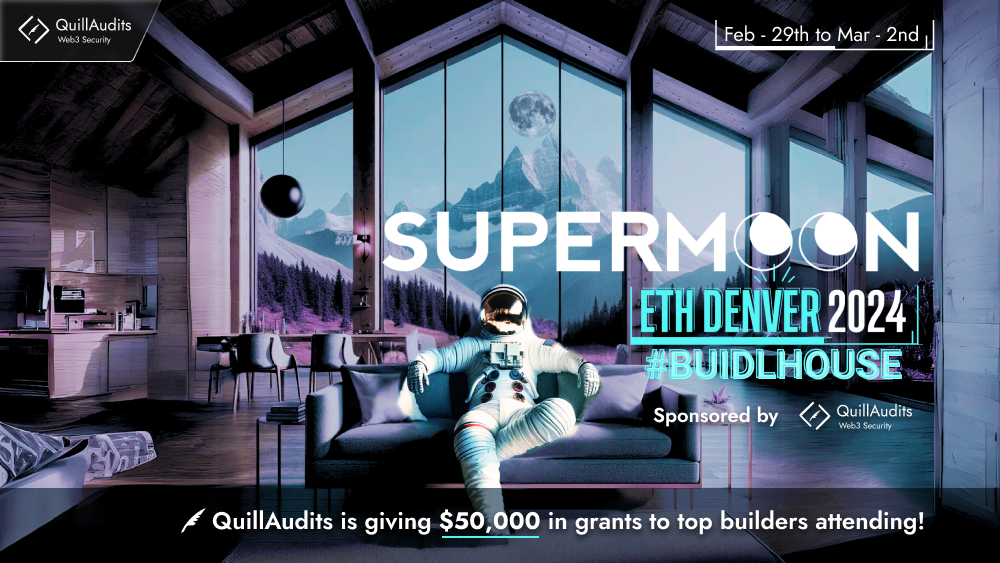

Reach out to QuillAudits

QuillAudits is accomplished in delivering efficient smart contract audits. If you need any assistance in the smart contracts audit, feel free to reach out to our experts here!

Follow QuillAudits for more updates.

Twitter | LinkedIn | Facebook |Telegram